|

|

Author: Robert Rubinstein |

Your weekly guide to Sustainable Investment |

Invitation: Climate Infrastructure Discussion - Nov 13I'd like to invite you to a discussion on climate infrastructure development with Zoé Ormières-Selves and Emmanuel Walliser of Épopée Gestion. The session on November 13th at 16:00 CET will cover converting climate policy into viable projects, de-risking strategies, and scaling infrastructure investments. You can join here: https://us06web.zoom.us/meeting/register/9Znd6UfMRfaSEigteY6iAg#/registration |

|

|

The Unicorn Hustle: Why Silicon Valley's Innovation Theater Is Just Financial Strip-Mining With Better PR

Robert RubinsteinVisionary Chairman & Thought Leader | Pioneering Impact Investing & ESG | Sustainable Finance Catalyst | Building Values-Based EconomiesLet's talk about something nobody wants to say out loud at Sand Hill Road cocktail parties: The venture capital industry isn't funding innovation anymore. It's running a sophisticated wealth extraction scheme dressed up in hoodies and buzzwords. The $50 Million Toast Delivery AppYou've seen the headlines. Stanford dropout raises obscene amounts for an app that solves problems nobody has. Former Big Tech employee gets nine figures for "Uber for X." VC firm invests in a company with no revenue, no product, but a killer deck about "changing the world." Here's what's actually happening: We've turned innovation funding into a Ponzi scheme where early investors cash out by convincing later investors to buy in at absurd valuations. Whether the company ever makes a dollar doesn't matter. What matters is the next round, the next sucker, the next headline. Remember when "unicorn" meant something that doesn't exist? The VC industry took that mythical creature and said, "Perfect! Let's name our billion-dollar companies with no path to profitability after imaginary beasts!" The irony writes itself. The Beautiful Math of 2-and-20Let me walk you through the most elegant swindle in modern finance. You're a VC firm managing a billion-dollar fund. You immediately collect $20 million annually in management fees—before investing a single penny, before creating any value, before doing anything except convincing people to give you their money. That's $200 million over ten years. Guaranteed. Win or lose. But wait—if the fund actually performs well, you take 20% of the profits too. So you can collect $600 million for managing other people's money, whether or not you actually generate returns for those people. Tell me another job where you can be wrong 80% of the time and still make hundreds of millions. This creates a perverse incentive: VC firms are motivated to raise bigger and bigger funds (bigger fees), push for faster exits (need those headline returns for the next fund), and inflate valuations beyond reality (makes early bets look brilliant on paper). Which is how you get WeWork at $47 billion. Theranos at $9 billion. And countless other unicorns whose horns turned out to be papier-mâché. Private Equity: Stripping Companies Like Cars in a Bad NeighborhoodIf VCs are flashy con artists, private equity firms are methodical mob enforcers showing up with baseball bats and calculators. The playbook is brutally simple:

Remember Toys "R" Us? Private equity firms bought it with $1.3 billion down and $5.3 billion in debt. The company paid $400 million annually just on interest—money that couldn't be invested in competing with Amazon. By 2017, it was bankrupt, 33,000 people lost jobs, but the PE firms had already extracted over $470 million in fees. They call this "unlocking hidden value" and "improving operational efficiency." I call it what it is: financial strip-mining. The IPO: Initial Plunder OpportunityHere's the grand finale—the moment when insiders dump their overvalued shares onto the unsuspecting public. The company burns through capital for years at increasingly ridiculous valuations. When private investors finally run out of appetite (or patience), it's time to "go public." Investment banks intentionally underprice the IPO to ensure a first-day "pop" that generates headlines. Who benefits from leaving money on the table? The banks, the institutional investors who get early allocations, and the insiders who can sell into the hype. Who loses? The company (gets less capital) and public investors (pay inflated prices). Then, 3-6 months later, when lock-ups expire, there's a flood of insider selling. By this point, all the "change the world" rhetoric has to contend with boring things like actual revenue and profit. And for most unicorns, those numbers aren't pretty. The early investors have already cashed out. The founders have diversified. The VCs have distributed shares to their limited partners. And your 401(k) is left holding the bag. Impact Washing and Climate TheaterNow capitalism has discovered the ultimate PR move: slap "impact" or "climate" on the same extraction machine and suddenly you're saving the world! Impact investing sounds noble—positive social impact alongside financial returns. But when those two goals conflict, financial returns win every single time. Otherwise, it wouldn't be venture capital, would it? Climate tech is the latest gold rush. Billions flowing into startups that can tell a climate story while fitting the VC model: software with high margins, minimal capital requirements, explosive growth potential. Carbon offset marketplaces? Perfect VC investment—software platforms with transaction fees. Whether they actually help the climate is a secondary concern at best. Green credit cards that plant trees? Great consumer fintech play with recurring revenue. Also completely ineffective at addressing systemic climate issues. Meanwhile, the hard, capital-intensive work of actually decarbonizing our economy—building clean energy infrastructure, retooling factories, retrofitting buildings—struggles to attract funding. Not sexy enough. Returns too slow. Margins too thin. The clock is ticking, but hey, at least we've got unicorns. What's your experience with VCs or PE? Have you seen the patterns described here? Let's talk about building something better. 👉 Follow Robert Rubinstein for more #VentureCapital #PrivateEquity #StartupLife #Innovation #SustainableFinance #TrustVC #VentureCapital #PrivateEquity, #StartupLife #Founders #Entrepreneurs #Investors #ESG #ImpactInvesting #ClimateTech #RadicalTruth #RegenerativeEconomy. #TrustVC This is an adaptation from the upcoming book, "Radical Truth." Think your network needs to hear this? Share it. Let's start a real conversation. |

|

|

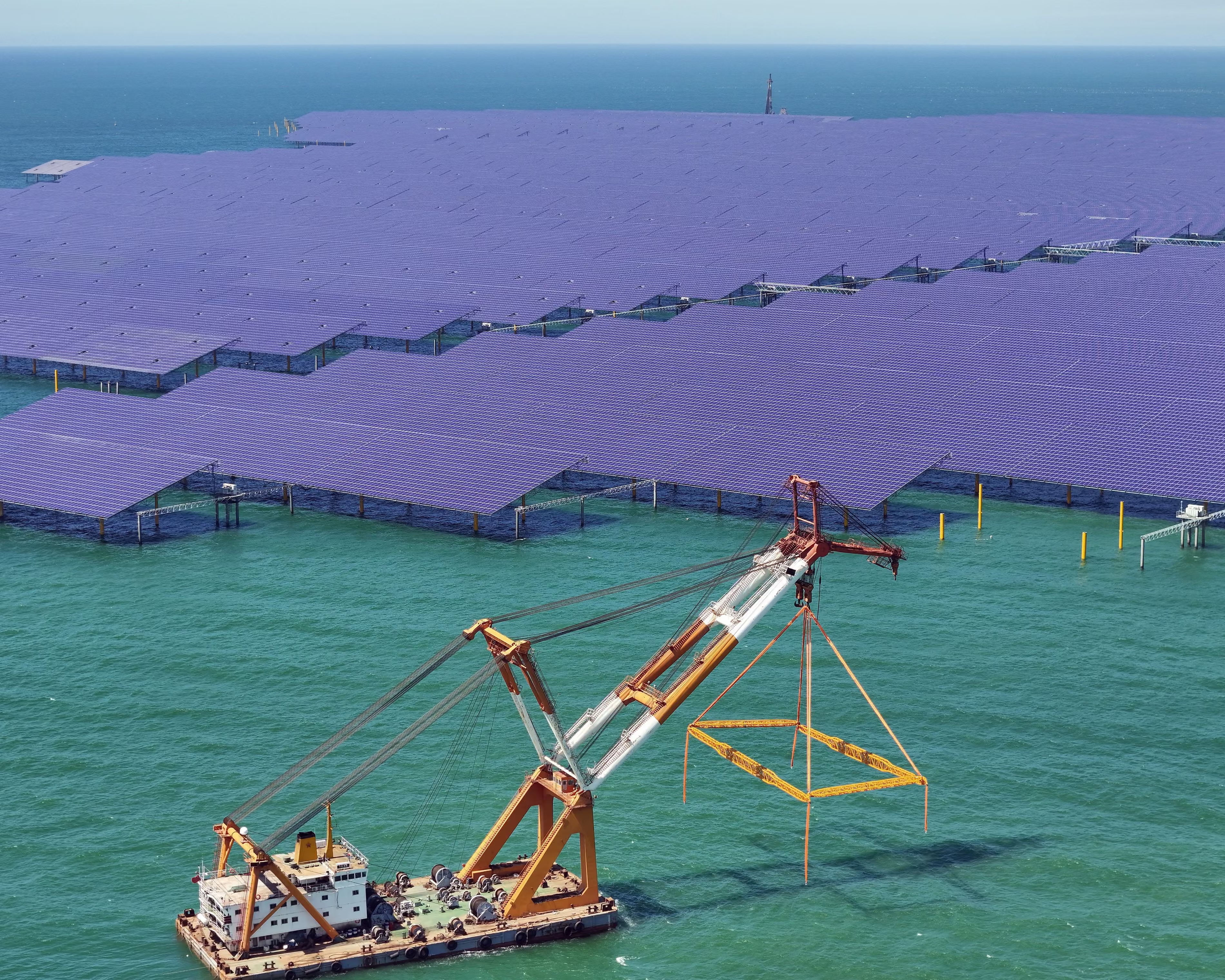

China’s CO2 emissions have been flat or falling for past 18 months, analysis findsWorld’s biggest polluter on track to hit peak emissions target early but miss goal for cutting carbon intensity Amy Hawkins Senior China correspondent China’s carbon dioxide emissions have been flat or falling for 18 months, analysis reveals, adding evidence to the hope that the world’s biggest polluter has managed to hit its target of peak CO2 emissions well ahead of schedule. Rapid increases in the deployment of solar and wind power generation – which grew by 46% and 11% respectively in the third quarter of this year – meant the country’s energy sector emissions remained flat, even as the demand for electricity increased. China added 240GW of solar capacity in the first nine months of this year, and 61GW of wind, putting it on track for another renewable record in 2025. Last year, the country installed 333GW of solar power, more than the rest of the world combined. The analysis by the Centre for Research on Energy and Clean Air (Crea), for the science and climate policy website Carbon Brief, found China’s CO2 emissions were unchanged from a year earlier in the third quarter of 2025, thanks in part to declining emissions in the travel, cement and steel industries. The findings come as global leaders gather in Brazil for Cop30, which is taking place against a backdrop of increasing urgency in the fight against the climate crisis. China’s president, Xi Jinping, did not attend the leaders summit at the UN climate conference, but the Chinese delegation are present for the talks. Xi’s US counterpart, Donald Trump, also did not attend and has not sent a negotiation team either. Last week, the UN secretary general, António Guterres, said the world was facing a “moral failure and deadly negligence” if governments failed to limit global heating to 1.5C. On Monday, André Corrêa do Lago, the Brazilian diplomat and president of Cop30, praised Chinese progress on green technologies. “China is coming up with solutions that are for everyone, not just China,” he said, adding that rich countries had lost their enthusiasm for tackling the climate crisis. “Solar panels are cheaper, they’re so competitive [compared with fossil fuel energy] that they are everywhere now. If you’re thinking of climate change, this is good.” |

AXA IM Alts Raises $560 Million for Nature-Based Solutions Strategyby Mark Segal • November 10, 2025

|