Your weekly guide to Sustainable Investment

Barney Swan is a TBLI Hero for turning bold climate vision into measurable impact. From skiing to the South Pole on renewables to regenerating Australia’s Daintree Rainforest, Barney leads with courage, clarity, and action.

As Founder of ClimateForce, he restores ecosystems, supports indigenous communities, and builds Smart Rainforest tech with NTT DATA to monitor biodiversity in real time. His work blends ESG innovation with grassroots restoration, proving that sustainability isn’t a slogan but a system. He is the guy digging the holes, not cutting the ribbons.

Barney embodies the TBLI ethos: integrity, climate intelligence, and doing the hard work to create a thriving planet. Most importantly, Barney is a true mensch and class act.

TBLI Radical Truth Podcast

Beyond the Checkbox: How Institutional Investors Can Truly Integrate Sustainability? /w Matt Christensen

Welcome to TBLI Radical Truth, the podcast that exposes the blind spots in sustainable finance and elevates the voices pushing for real transformation.

In this episode, we’re joined by Matt Christensen, Global Head of Sustainable and Impact Investing at Allianz Global Investors, and a globally recognised leader in responsible investment strategy.

In “Beyond the Checkbox,” Matt breaks down what it really means to integrate sustainability at the institutional level. Not just adding ESG screens or publishing glossy reports—but embedding sustainability into the core of investment processes, risk management, and long-term value creation.

With decades of experience spanning policy, capital markets, and global fund management, Matt offers sharp insights into the evolving expectations facing asset managers, and the tools they need to move from intention to impact.

Whether you're an institutional investor, an ESG professional, or simply someone who believes capital should serve people and planet, this conversation is packed with strategic guidance and hard truths.

Listen to the full podcast

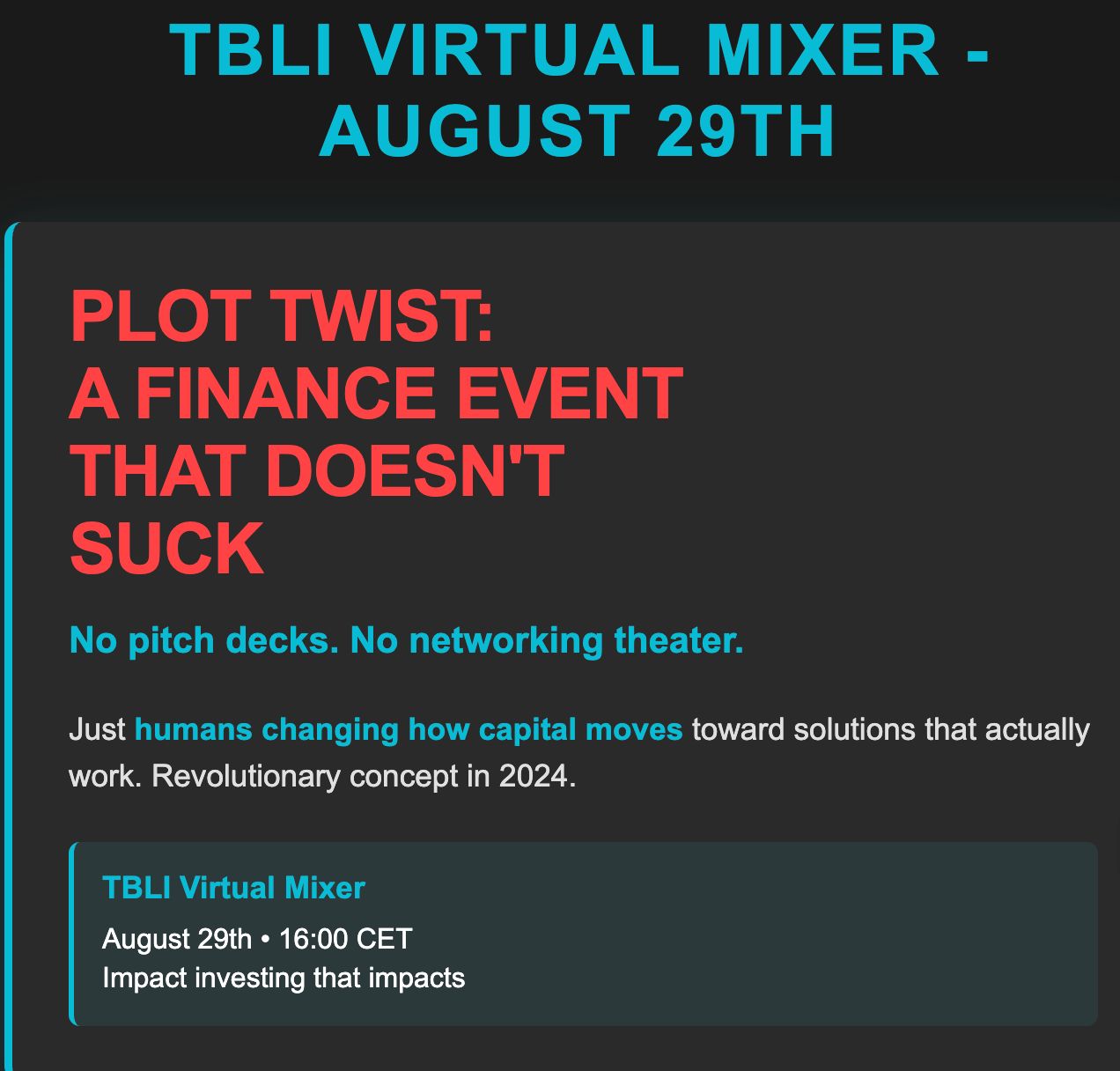

TBLI Virtual Mixer

TBLI Virtual Mixer Speed networking with values-aligned peers.

Our matchmaking system connects you No fluff. No travel. Just real, purpose-driven conversations.

Limited space — join early!

TrustVC

.jpg)

What if founders could rate investors, and LPs could spot red flags early? That’s the idea behind TrustVC.org, a new TBLI Group initiative bringing sunlight to startup funding. Why it matters:

Too many founders get ghosted. Too many LPs find out too late. TrustVC changes that by: Letting founders review VCs and PE firms Helping LPs identify trusted fund managers Highlighting fair, founder-friendly investors

How to support:

✅ Share TrustVC with your network

✅ Encourage founders to post reviews

✅ Add any missing firms

Just launched: TrustVC.org — the investor review platform VCs never wanted, but founders always needed.

If you’ve worked with investors, please leave a review or add a firm. Let’s bring some sunlight to startup funding

Join TBLI Circle and expand your Impact network

Join TBLI Circle — A Community Where Purpose Leads and Impact Grows

If you're tired of extractive networks, shallow conversations, or “impact” in name only, TBLI Circle is your antidote.

This is not just another platform. It’s a curated circle of professionals who believe finance should serve all stakeholders, not just shareholders.

Whether you’re in transition, seeking deeper alignment, or ready to collaborate on work that truly matters, TBLI Circle gives you something rare:

💬 Real relationships.

🌍 Shared values.

🤝 Trusted connections.

⚡ Momentum for your mission.

No ego. No greenwashing. Just people who care.

If you’ve been searching for the right room — this is it.

Chapter from the upcoming Book: Radical Truth

The Great ESG Con Job: How We Turned Saving the World Into a $50 Trillion Circle Jerk

By: Robert Rubinstein

You know what I love about the ESG industry? The sheer audacity. The balls. Here we have an entire economic ecosystem built on the premise that we can save the world by filling out more forms. It's like trying to cure cancer with Post-it notes.

Fifty trillion dollars. That's what they tell us is flowing into ESG investments. Fifty. Trillion. With a T. That's more money than most people can conceptualize. It's like trying to count the number of times a sustainability consultant has said "stakeholder engagement" in a single PowerPoint presentation – the human mind simply cannot process such astronomical numbers.

And yet, here we are, living on a planet that's still cooking itself like a forgotten burrito in capitalism's microwave, while everyone in finance pats themselves on the back for buying the "sustainable" version of the same old shit.

The Magnificent Measurement Circus

Let me tell you about ESG measurement. It's like having your morality judged simultaneously by a Catholic priest, a Buddhist monk, a secular humanist, and your judgmental Aunt Mildred – each using different criteria, none of them talking to each other, and all of them charging consulting fees.

We've got more acronyms than a government agency having an identity crisis: PRI, CDP, GRI, B Corp, MSCI, S&P, and about forty others I can't pronounce. Each one has developed their own special sauce for determining whether a company is saving the world or destroying it. It's like having forty different ways to measure your dick – impressive in its variety, but ultimately missing the point.

And here's the beautiful part: a company can be an ESG saint according to one rating agency and a complete environmental terrorist according to another. It's Schrödinger's sustainability – you're simultaneously green and brown until someone opens the ratings box.

The Consultant Feeding Frenzy

You want to know who's really winning in this ESG bonanza? The consultants. Oh, the consultants. They've turned sustainability into the world's most expensive self-help seminar.

"Need to improve your carbon disclosure score? We've got a methodology for that! Want to align with seventeen different reporting frameworks that contradict each other? We've got a software solution! Looking to turn your environmental destruction into a compelling narrative about transition? We've got a team of former English majors who specialize in corporate poetry!"

It's a full-employment program for people with master's degrees in things ending with "studies." They're not bad people – most started out wanting to save whales or something. But somehow they ended up in conference rooms explaining why a company that burns forests for breakfast still deserves a B+ in sustainability because they use recycled paper in their headquarters bathroom.

The "Best in Class" Delusion

My favorite ESG magic trick is the "best in class" rating. You know what that means? It means you're the prettiest horse in the glue factory.

So ExxonMobil gets a stellar ESG rating because they're the "best" oil company. It's like giving someone a gold medal in the "Least Murderous Serial Killer" category. Sure, Ted only killed three people this year compared to Jeffrey's twelve, but maybe – and I'm just spitballing here – we shouldn't be handing out awards in the serial killer division at all.

Meanwhile, some scrappy renewable energy startup gets a mediocre rating because they haven't hired a team of twenty sustainability consultants to translate their actual environmental benefits into the preferred corporate bullshit dialect.

The Great Refusal

Here's where it gets really funny. When someone actually tried to get these measurement mavens together to compare their methodologies side by side – you know, basic transparency in the transparency business – the big players ran away like vampires from a garlic festival.

MSCI, CDP, all the heavy hitters: "Oh no, we can't possibly show you how our secret sauce works. That would be... uh... proprietary. Yeah, proprietary. Definitely not because our methodology is held together with wishful thinking and corporate sponsorship money."

It's like a chef refusing to let you see their kitchen because they're worried you'll discover their "farm-to-table organic gourmet meal" actually comes from the dumpster behind McDonald’s.

And Now, Ladies and Gentlemen: The AI Revolution

But wait! There's more! Just when you thought the ESG measurement circus couldn't get any more absurd, along comes artificial intelligence to crash the party like a robot with a calculator and zero patience for bullshit.

You see, AI doesn't need to charge $500 an hour to tell you that a company dumping toxic waste into rivers might not be "sustainable." AI doesn't need three months and a team of consultants to figure out that a company's carbon emissions went up, not down. AI can read satellite data, parse supply chain information, and analyze actual environmental impact without needing to be wined and dined by the companies it's evaluating.

Here's what's coming: Some kid in a garage is going to build an algorithm that can assess a company's real environmental and social impact in about fifteen minutes using publicly available data, satellite imagery, and social media sentiment analysis. It'll be more accurate than anything MSCI has ever produced, it'll cost about as much as a Starbucks latte, and it won't have any conflicts of interest because it doesn't play golf with CEOs.

The entire ESG consulting industrial complex is about to get disrupted harder than the taxi industry when Uber showed up. All those armies of consultants charging thousands of dollars to help companies "improve their CDP scores"? They're about to be replaced by software that costs fifty bucks a month and actually measures things that matter.

The beautiful irony is that the ESG industry – which loves to talk about "innovation" and "technology" and "digital transformation" – is about to get steamrolled by the very technologies they've been name-dropping in their PowerPoints for years.

Most of these measurement firms don't even realize they're already dead. They're still hiring MBAs and expanding their "methodology teams" while AI is quietly learning to do their entire job better, faster, and without the moral flexibility that comes from being paid by the companies you're supposed to be objectively evaluating.

Read full article

AI can be ‘catalyst for positive social environmental and social outcomes’, report

By: Krystle Higgins - Impact Investor

In its latest impact report, Union Bancaire Privée (UBP) explores the dilemma AI’s rapid expansion poses to impact investors.

As artificial intelligence (AI) adoption continues to grow, its surging energy demands could threaten to derail corporate net-zero commitments. Yet, alongside these risks, AI is also emerging as a tool to support biodiversity preservation, such as sustainable farming practices, according to Swiss asset manager Union Bancaire Privée (UBP).

During a roundtable in London to present its latest impact report, UBP explored this duality, highlighting both the emissions intensive nature of AI infrastructure as well as its potential as a driver of sustainability solutions.

“AI is rapidly transforming the landscape of equity investing,” the report said. “For positive impact investors, AI presents a powerful enabling technology, one that, like electricity or the internet, can be used for both good and bad depending on how it is applied. Our focus is on how AI can serve as a catalyst for positive social and environmental outcomes while generating sustainable financial returns.”

Mathieu Nègre, UBP’s head of impact investing, said: “AI has created a few dilemmas for impact investors and has created a huge source of increasing power that is causing companies like Microsoft to backtrack on their climate plans.”

Despite these challenges, UBP points to examples of AI driving positive change in sectors such as agriculture. One current example looks at John Deere’s AI-enabled ‘See & Spray’ technology which cuts herbicide use by nearly 60%, something UBP considers to be a breakthrough in sustainable farming. Meanwhile, climate solutions provider Trane Technologies is deploying AI-powered digital twins, a virtual representation of a physical object or system, to optimise energy use across its asset base, reducing emissions at scale.

Another example is the work being done by nature data provider Nature Alpha, which is using AI to overlay geospatial data with corporate asset locations, enabling more accurate assessments of nature-related risks. According to UBP, these tools can help investors align their portfolios with emerging biodiversity frameworks and better manage exposure to ecosystem degradation.

“We’re not focused on backing the firms building AI itself,” Nègre said. “Instead, we’re targeting companies applying AI in ways that generate measurable environmental and social benefits.”

UBP said it views AI as an “enabling technology” and is directing capital towards improving the sustainability of AI infrastructure, such as data centre efficiency and chip manufacturing. But the firm said it sees the most promising developments at the application layer, where AI is embedded into solutions tackling real world challenges, from healthcare and education to financial inclusion and climate resilience.

However, the report warns that AI’s rapid adoption comes with risks. Models trained on biased or incomplete datasets may perpetuate inequalities, underscoring the need for strong governance and oversight.

“The rise of AI driven decision making underscores the importance of transparency, explainability, and alignment with evolving regulatory standards,” the report concluded.

Source

New York becomes first state to commit to all-electric new buildings

The state finalized rules ensuring most new edifices will install electric heat pumps and stoves instead of gas appliances, lowering costs and improving air quality.

On July 25, the State Fire Prevention and Building Code Council approved an all-electric building standard, making New York the first state in the nation to prohibit gas and other fossil fuels in most new buildings. Legislators and climate advocates celebrated the move, which had been mandated under the pathbreaking 2023 All-Electric Buildings Act.

“I’m excited that we are finally tackling, statewide, our largest source of fossil-fuel emissions,” said state Assemblymember Emily Gallagher, who sponsored the 2023 legislation. Buildings account for 31 percent of the Empire State’s planet-warming pollution.

New York is forging ahead on building decarbonization at the same time the federal government is backtracking, yanking support for renewable power and home energy efficiency and providing the fossil-fuel industry with new subsidies.

The state’s rules will apply to new structures up to seven stories tall and, for commercial and industrial buildings, up to 100,000 square feet beginning Dec. 31, 2025. Buildings bigger than that will need to be built all-electric starting in 2029. The new code will spur installations of heat pumps and heat-pump water heaters — ultra-efficient electric appliances that are good for the planet and, typically, pocketbooks.

The council left room for exceptions, though, including new laboratories, crematoriums, restaurants, and large buildings whose owners can prove the grid isn’t ready to accommodate their sizable all-electric heating needs. Michael Hernandez, a policy director at electrification advocacy nonprofit Rewiring America, said he doesn’t think the exemptions will eat away at the code’s efficacy, however.

With the rules finalized, “I’m relieved,” Gallagher told Canary Media. Fossil-fuel interests — such as the utility front group, New Yorkers for Affordable Energy — “really worked overtime to try to stop this,” she said.

The new regulations come on the heels of a recent legal victory: On July 23, a federal district court in New York upheld the state’s ability to implement the All-Electric Buildings Act.

The groups challenging the law in court — including the New York State Builders Association, National Association of Home Builders, National Propane Gas Association, and a few local union chapters for plumbers and electricians — alleged that it’s preempted by the federal Energy Policy and Conservation Act, the same justification used to overturn Berkeley, California’s pioneering ban on gas hookups in new construction. The New York judge was unconvinced by this argument, noting that the Berkeley decision relied on “deficient interpretations” of terms like “energy use,” and is “simply not persuasive.”

Opponents of the standard haven’t quit, though. An industry coalition that includes many of the organizations that brought the lawsuit sent a letter on June 26 to U.S. Attorney General Pam Bondi requesting that the Department of Justice move to block the code from taking effect. Michael Fazio, lead author of the letter and the executive director of the New York State Builders Association, declined to comment on the request’s status to Canary Media.

The state’s new energy code is expected to raise the cost of residential construction but also lower energy bills substantially for homeowners and renters, making it cost-effective overall with a payback of 10 years or less, according to a report commissioned by the New York State Energy Research and Development Authority. Over 30 years, households are expected to save an average of about $5,000 due to a 17 percent reduction in energy use.

Other research indicates all-electric construction is typically less expensive than that for buildings equipped to burn gas or fuel oil. Electric-only projects allow developers to forgo installing costly fossil-fuel infrastructure alongside the electrical systems requisite in modern buildings. A 2022 analysis by the decarbonization nonprofit New Buildings Institute, for example, found that building an all-electric single-family home in New York costs about $8,000 less.

The all-electric code will improve air quality by reducing reliance on fossil-fuel-fired boilers, furnaces, water heaters, and stoves. These conventional appliances spew harmful byproducts such as carbon monoxide, particulate matter, benzene, nitrogen oxides, and more, which can cause respiratory and cardiovascular issues — to lethal effect. In 2017, fossil-fuel use from New York buildings caused $21.7 billion in health impacts and nearly 2,000 premature deaths, more than in any other state.

Gas stoves, typically the largest sources of exposure to indoor air pollutants, are linked to nearly one in five asthma cases in children in New York, according to a 2022 study. “Places like the Bronx have the highest rates of childhood asthma in the country,” said Jumaane Williams, public advocate of New York City, in a call with reporters on Friday. “We know this is a life-and-death situation.”

Central California issues evacuation orders after wildfire burns 72,000 acres

At least three people injured and over 450 structures under threat by Gifford blaze, with only 3% of perimeter contained

A huge wildfire in central California has threatened hundreds of homes, with blazes churning through the brush-covered hillsides in Los Padres national forest.

At least three people were reported injured, and more than 450 structures were under threat by the Gifford fire, officials said on Monday.

The fire had scorched more than 72,000 acres (29,000 hectares)as of Monday evening, after the blaze grew out of several smaller fires that erupted Friday along State Route 166 between Santa Maria and Bakersfield.

The fire was burning along coastal Santa Barbara and San Luis Obispo counties, north of Los Angeles.

By Monday night, the fire was considered 5% contained, according to the CalFire state agency. Officials had earlier cautioned residents conditions could rapidly change due to erratic fire behavior. Hotter and drier weather in the forecast is expected to “facilitate rapid and sustained fire growth”, according to an incident report issued on Monday.

More than 1,000 firefighters were scrambling to make progress against the flames, before so-called sundowner winds whip up around dusk. The National Weather Service had said gusts could reach 25mph (40km/h) in the fire area.

The cause of the fire is under investigation.

One motorist suffered burn injuries after getting out of his vehicle and being overrun by flames and was forced to be hospitalized, according to Flemming Bertelson, a US Forest Service spokesperson. Two contract workers helping firefighters also suffered injuries when their all-terrain vehicle overturned.

Ranchers were also forced to evacuate cattle as aircrafts conducted water drops on rapidly spreading flames, the Associated Press reported.

Don Fregulia, an operations section chief for the California interagency incident management team, said in a Monday afternoon update that firefighters were battling “extremely challenging and difficult terrain” in the San Rafael Wilderness area, which is part of the national forest. He said smoke was making it difficult for aircrafts to see and authorities were using infrared. There was cleaner air on the northern area of the fire, he said, and firefighters had some success containing the spread in certain areas.

A heatwave could exacerbate fire risks later this week, with temperatures expected to climb above 100F (38C) in parts of inland southern California from Wednesday through at least Saturday, the LA Times reported. The heat is also expected to impact inland areas in the northern part of the state.

Conditions across California continue to be primed for high fire risk after a warmer and drier spring left landscapes parched. Fire activity typically accelerates in the state around the end of summer and into autumn, but wildfire activity has already been trending above normal, according to CalFire.

Green Energy for Everyone: Tokenisation Lowers Barriers to Sustainable Investing

A blockchain expert says while there is significant investor interest in green energy, participation is largely limited to large institutional players due to challenges like high upfront costs. The expert believes tokenization can democratize investment in sustainable projects.

Tokenization: Democratizing Green Energy Investment

The global push for green energy and energy independence has ignited immense investor interest, yet significant barriers continue to limit participation primarily to large institutional players. Mete Al, Co-founder of ICB Labs, argues that this dynamic is about to change dramatically, with tokenization emerging as the key to democratizing investment in sustainable projects.

“Green energy has huge investor interest, but it’s mostly limited to big players,” explains Al. He points to the inherent challenges of large-scale green projects: the need for substantial upfront capital, lengthy development timelines, and the critical issue of trust, particularly when projects are located in remote or unfamiliar regions. “That shuts out regular people.”

This is where tokenization, the process of transforming ownership rights of tangible assets into divisible digital tokens on a blockchain, becomes a game-changer. Al, a expert in blockchain and cryptocurrency, emphasizes its transformative potential: “By splitting ownership of solar farms into tokens, anyone can invest, earn passive income, and support sustainability, without needing to own land or infrastructure.”

This fractionalization of ownership dramatically lowers the entry barrier, allowing individuals to participate in large-scale renewable energy projects with relatively small investments. It shifts the paradigm from exclusive, high-capital ventures to an inclusive, accessible investment opportunity, channeling a broader pool of capital into the green energy sector.

Addressing the Remaining Hurdles

While tokenization does offer a powerful solution, Al acknowledges that the path is not entirely without obstacles. “Of course, there are still challenges: regulations, stable pricing, tech limitations, and above all, transparency,” he notes.

However, he asserts that blockchain technology provides crucial tools to overcome these. The inherent transparency and immutability of blockchain records are fundamental, but Al stresses that true effectiveness comes from strategic implementation. “What really makes it work is smart contracts that link earnings to real output, dashboards to track everything, and fair reward systems.”

This vision goes beyond mere digital representation; it’s about creating a verifiable, automated, and equitable ecosystem for green energy investment. Smart contracts can ensure that passive income is automatically distributed to token holders based on the actual energy generated by the solar farm, fostering trust and direct alignment of incentives. Transparent dashboards provide real-time performance data, giving investors clear visibility into their environmental and financial impact.

Mete Al reveals that his company, ICB Labs, is not just observing this trend but actively building solutions. “That’s exactly how we’re building our solar tokenization project for 2026,” he states, signaling a tangible commitment to bringing this innovative model to fruition.

By focusing on these core principles – accessibility, transparency, and a direct link between investment and real-world green energy output – tokenization promises to unlock a new era for sustainable finance. It holds the potential to accelerate the deployment of green energy installations worldwide, moving closer to a future of energy independence and environmental sustainability, powered by a truly democratic investment landscape.

Read full article