Your weekly guide to Sustainable Investment

TBLI Radical Truth Podcast

Medical Debt Abolishment: A $10 Billion Intervention in Economic Justice

In this episode, of Radical Truth, we’re joined by Allison Sesso, President & CEO of Undue Medical Debt a groundbreaking nonprofit that has already erased over $10 billion in medical debt—and counting.

In “Medical Debt Abolishment,” we explore how a seemingly intractable crisis—medical debt—is being tackled through an elegant, highly leveraged model. With 1 in 4 Americans burdened by medical debt and millions pushed toward bankruptcy, Allison and her team are proving that medical debt relief isn’t just charity—it’s a powerful form of economic and social intervention.

Undue Medical Debt turns every $1 donated into $100 of debt relief, targeting individuals most in need. Backed by visionary philanthropists like MacKenzie Scott, their work not only reduces suffering but restores financial dignity across communities nationwide.

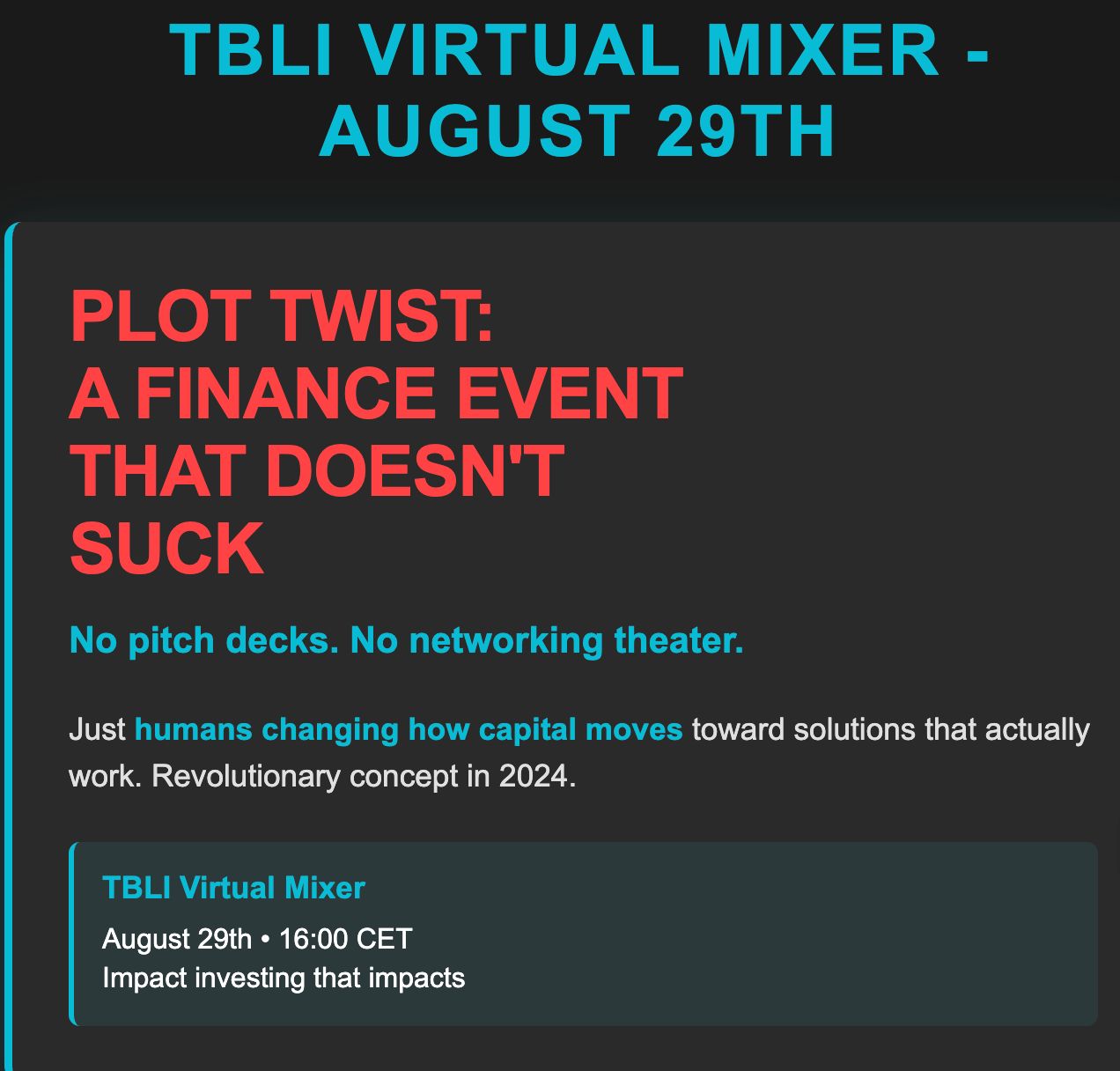

TBLI Virtual Mixer

TBLI Virtual Mixer Speed networking with values-aligned peers.

Our matchmaking system connects you No fluff. No travel. Just real, purpose-driven conversations.

Limited space — join early!

TrustVC

.jpg)

What if founders could rate investors, and LPs could spot red flags early? That’s the idea behind TrustVC.org, a new TBLI Group initiative bringing sunlight to startup funding. Why it matters:

Too many founders get ghosted. Too many LPs find out too late. TrustVC changes that by: Letting founders review VCs and PE firms Helping LPs identify trusted fund managers Highlighting fair, founder-friendly investors

How to support:

✅ Share TrustVC with your network

✅ Encourage founders to post reviews

✅ Add any missing firms

Just launched: TrustVC.org — the investor review platform VCs never wanted, but founders always needed.

If you’ve worked with investors, please leave a review or add a firm. Let’s bring some sunlight to startup funding

Join TBLI Circle and expand your Impact network

Join TBLI Circle — A Community Where Purpose Leads and Impact Grows

If you're tired of extractive networks, shallow conversations, or “impact” in name only, TBLI Circle is your antidote.

This is not just another platform. It’s a curated circle of professionals who believe finance should serve all stakeholders, not just shareholders.

Whether you’re in transition, seeking deeper alignment, or ready to collaborate on work that truly matters, TBLI Circle gives you something rare:

💬 Real relationships.

🌍 Shared values.

🤝 Trusted connections.

⚡ Momentum for your mission.

No ego. No greenwashing. Just people who care.

If you’ve been searching for the right room — this is it.

Verdama Earth Appoints Sustainable Finance Pioneer Robert Rubinstein as Chairman to Accelerate Global Nature Protection and Restoration

PRESS RELEASE

FOR IMMEDIATE RELEASE

New York, 28th of July 2025

Verdama Earth, a purpose-driven climate finance company, is pleased to announce the appointment of Robert Rubinstein as Chairman of the Board. A respected pioneer in sustainable and nature finance, Mr. Rubinstein is the founder of TBLI Group and has been instrumental in shaping the global impact investment landscape over the past three decades.

His appointment marks a strategic milestone for Verdama Earth as it scales its mission to channel capital into the protection and restoration of the world’s most critical ecosystems , beginning with its high-impact landscape approach programmes in Latin America. “We are honoured to welcome Mr. Rubinstein as chairman of our board,” said Martina von Richter , Executive Director of Verdama Earth. “He brings an extraordinary combination of strategic insight, deep sector expertise, and values-driven leadership that will strengthen our global positioning and partnerships across the climate finance ecosystem.”

Verdama Earth works at the intersection of nature conservation, carbon markets, and community resilience , designing innovative projects that deliver measurable environmental outcomes and equitable social benefits . The organization collaborates closely with leading project consultants, Indigenous and local communities, and institutional buyers to ensure integrity from design through delivery.

With Mr. Rubinstein’s guidance, Verdama Earth aims to mobilize a new generation of climate-aligned capital to safeguard key biodiversity areas and accelerate large-scale restoration. “We need credible, mission-led actors in the nature finance and project space—those who combine climate science with local knowledge and transparent governance,” said Mr. Rubinstein. “Verdama Earth embodies that vision, and I am proud to support its mission.”

About Verdama Earth

Verdama Earth is focused on reversing biodiversity loss, strengthening community livelihoods, and accelerating climate action through high-integrity nature-based solutions. By aligning itsprojects and capital with ecological priorities, Verdama Earth aims to deliver meaningful impact for people and the planet.

Media Contact:

Martina Von Richter

Executive Director

mvr@verdama.earth

+353 87 118 2601

The Death-Defying Delusion: Why Billionaires Think Mortality Is Just Another Problem to Solve

Have you noticed how billionaires are taking death personally these days? Like it's some kind of insult specifically directed at them? The rest of us accept death like we accept taxes and bad weather—an inevitability that occasionally ruins a picnic. But billionaires? They're offended by the concept.

While you're setting up your measly 401(k), hoping to enjoy five years of retirement before your knees give out, the tech titans are launching an all-out assault on mortality itself. They're not planning for retirement but for their next millennia. It's the ultimate rich-guy move: "I'll take everything, including time itself."

These "titans" aren't content with owning most of the world's wealth; now they want to monopolize existence too. It's like watching someone win at Monopoly and then insist they get to play forever while everyone else has to go home. "Sorry, did you want to exist too? Should've founded a successful tech company in your twenties!"

What we're witnessing isn't just wealth accumulation—it's the ultimate expression of humanity's oldest delusion, turbocharged by billions in disposable income. "Death? We're looking into a hostile takeover of that operation. Should be finalized by Q3."

The Navy SEAL Morning Routine (But Make It Billionaire)

Let's peek into the daily routine of your average billionaire life extender. First of all, they wake up at 4:30 AM—not because they have to, but because being unconscious for eight hours straight feels too much like a trial run for death. Their morning routines would make a Navy SEAL say, "Whoa, buddy, maybe dial it back a notch?"

Picture this: A morning "wellness shot" that looks like something you'd find in a sewage treatment plant but costs more than your monthly rent, followed by an ice bath that would make a polar bear file a workplace complaint. "The discomfort is worth it," they tell themselves while their nervous system screams bloody murder. "This is how I'll outlive everyone who ever doubted me on X, formerly known as Twitter."

Jeff Bezos doesn't merely work out; he prepares his body as if it's the next package to be shot into space. The man once delivered packages; now he delivers punishing blows to mortality through a regimen of weights, cardio, and experimental peptides flown in from a lab in Switzerland. His bald head gleams with the sweat of immortality pursuits. When he flexes, you can almost hear the Grim Reaper sigh and check his watch.

Meanwhile, their personal chefs prepare meals with ingredients so rare and exclusive that some don't even have names yet, just numerical designations from the labs that synthesized them.

"Sir, would you like the XR-7 protein complex or the Telomerase Activator 9 with your breakfast?"

"Both. And add some blueberries. I read they have antioxidants."

"Excellent choice, sir. These blueberries were grown in volcanic soil on a mountain that doesn't appear on maps, watered exclusively with melted Himalayan glacier water, and harvested by monks who haven't spoken in forty years."

They don't have workouts; they have "scientifically optimized physical enhancement protocols." They don't have diets; they have "cellular nutrition strategies." They don't relax; they engage in "parasympathetic nervous system regulation exercises." They've transformed the most natural thing in the world—living—into the world's most complicated spreadsheet.

And it's all so very, very serious. There's no joy in their juice cleanses, no pleasure in their planking. It's all just input and output, cause and effect, a mathematical equation where the desired result is "not dying."

The Metrics of Mortality

Modern billionaires don't just passively hope to live longer—they quantify every aspect of their existence with the obsessiveness of a toddler counting Cheerios. Their bodies aren't flesh; they're data-generating devices constantly monitored for optimization opportunities.

"My sleep efficiency was only 94.3% last night," a concerned tech CEO tells his team of five sleep specialists on his $50,000-a-month payroll. "Find out why and fix it. I can't afford to lose those 34 minutes of REM sleep if I want to make it to 150." The specialists nod gravely as if sleep efficiency is more important than climate change.

These guys wear rings that monitor their heart rate variability, watches that analyze their gait, implants that track their glucose levels, patches that measure their stress hormones, and underpants that evaluate their testicular temperature with military-grade precision. Every bathroom includes a toilet that analyzes their waste for biomarkers of disease. Nothing says "living your best life" like having your excrement scrutinized by an AI that costs more than a Harvard education.

"Sir, your stool analysis indicates your selenium levels are 0.02% below optimal. Shall I alert the selenium response team?"

Their blood isn't just red stuff that keeps them alive; it's a constantly monitored performance metric. They have more blood tests in a month than most people have in a lifetime. Young blood transfusions? Sure, why not? "Young people's blood has rejuvenating properties," they explain, sounding not at all like vampires in business casual.

We're one step away from them building medieval-style castles and kidnapping virgins from nearby villages. "It's not evil! It's science! Look at the charts!"

They collect more information about their bodily functions than the NSA collects about your online activities. Every step, heartbeat, breath, and brainwave is logged, analyzed, and optimized. They know their cortisol levels at 3:42 PM on the second Tuesday of last month. Their gut microbiome has better documentation than most corporate mergers.

"I'm running at 89% today," they'll tell you with complete seriousness, as if humans are supposed to function like smartphones with battery indicators. Meanwhile, you're just happy you remembered to put on matching socks this morning.

Read full article

And why it’s not getting cheaper any time soon.

Americans are paying more for electricity, and those prices are set to rise even further.

In almost all parts of the country, the amount people pay for electricity on their power bills — the retail price — has risen faster than the rate of inflation since 2022, and that will likely continue through 2026, according to the Energy Information Administration, or EIA.

Just about everything costs more these days, but electricity prices are especially concerning because they’re an input for so much of the economy — powering factories, data centers, and a growing fleet of electric vehicles. It’s not just the big industries; we all feel the pinch firsthand when we pay our utility bills. According to PowerLines, a nonprofit working to reduce electricity prices, about 80 million Americans have to sacrifice other basic expenses like food or medicine to afford to keep the lights on. And it’s about to get even worse: Utilities in markets across the country have asked regulators for almost $29 billion in electricity rate increases for consumers for the first half of the year.

Why are prices rising so much all of a sudden? Right now, there are the usual factors driving the rise in electricity rates: high demand, not enough supply, and inflation. But there are problems that have been building up for decades as well, and now the bills are due: Aging and inadequate infrastructure needs replacement, while outdated business models and regulations are slowing the deployment of urgently needed upgrades.

On the campaign trail, President Donald Trump promised to bring energy prices down by increasing fossil fuel extraction. “My goal will be to cut your energy costs in half within 12 months after taking office,” Trump said last August in a speech in Michigan.

But electricity prices are still going up, and Trump’s signature legislative accomplishment, the One Big Beautiful Bill Act, is likely to raise prices further. Without better management and investment, the result will be more expensive and less reliable power for most Americans.

The variables baked into your power bill, explained

There are several key factors that shape how much you pay for electricity.

There’s the cost of building, operating, and maintaining power plants. Higher interest rates, inflation, tariffs, and longer interconnection queues — power generators waiting for approval to connect to the grid — are making the process of building a new electricity generator slower and more expensive. PJM, the largest power market in the U.S., said this week that soaring demand for electricity and delays in building new generators will raise power bills 1 percent to 5 percent for customers in its service area across 13 states and the District of Columbia.

Then there’s the fuel itself, whether that’s coal, oil, natural gas, or uranium. For renewables, the cost of wind, water, and sunlight are close to zero, but intermittent generators need conventional power plants or energy storage systems to back them up. Still, wind and solar power have been some of the cheapest sources of electricity in recent years, forming the dominant share of new power generation connecting to the grid.

That electricity then has to be routed from power plants over transmission lines that can span hundreds of miles and into distribution networks that send electrons into homes, offices, stores, and factories.

Then you have to think about demand, over the course of hours, days, months, and years. Some utilities offer time-of-use billing that raises rates during peak demand periods like hot summer afternoons and lowers them in evenings. Cooling needs are a big reason why overall electricity use tends to be higher in summer months than in the winter. And for the first time in a decade, the U.S. is experiencing a sustained increase in electricity use driven in part by a rapid build-out of power-hungry data centers, more EVs, more electric appliances, and more air conditioning to stay cool in hotter summers.

More users for the same amount of electricity means higher prices. The Trump administration’s rollback of key incentives for renewables and slowdown of approvals for new projects is likely to slow the rate of new generation coming online.

And the process of bridging electricity supplies with demand is becoming a bottleneck, thus comprising a larger share of the overall bill. “If you actually look at the cost breakdowns of what’s significantly increasing, it’s really the grid,” said Charles Hua, founder and executive director of PowerLines. “It is the poles and wires that make up our electric infrastructure that’s increasing in cost particularly rapidly.”

According to the EIA, just under two-thirds of the average price of electricity is due to generation costs, with the remainder coming from transmission and distribution. However, energy utilities are now putting more than half of their expenditures into transmission and distribution through the end of the decade. “It used to be the case maybe a decade ago where generation was the largest share of utility investments, and therefore customer bills,” Hua said. “But it has now been inverted where really it’s the grid expense that is rising and doesn’t show any signs of relief.”

There are several reasons for this. One is that the existing power grid is old, and many components like conductors and switchgear are reaching the ends of their service lives. Replacing 1960s hardware at 2025 prices raises operating costs even for the same level of service. But the grid now needs to provide higher levels of service as populations grow and as technologies like intermittent renewables and energy storage proliferate.

Power outages driven by extreme weather are becoming more frequent and longer, but hardening the grid against disasters like floods and fires is expensive too. Putting a power line underground can add up to double or more the price of stringing conductors along utility poles, which is why power companies have been slow to make the change, even in disaster-prone regions.

Read full article

‘Climateflation’ Could Push UK Food Prices Up by 34% by 2050, Alarming Report Finds

By: Hanaa Siddiqi - Sustainable Times

Britain is staring down the barrel of a deepening "climateflation" crisis as increasingly extreme weather threatens to send food prices soaring by over a third within the next 25 years.

In a sobering analysis, the Autonomy Institute warned that climate change is not only a long-term environmental issue but also a growing financial burden for ordinary UK households. The think tank’s latest report suggests that, without urgent intervention, rising food costs could push nearly one million more people below the poverty line.

The threat comes from multiple fronts. Heatwaves, droughts, and unstable weather patterns are expected to impact food production both domestically and globally severely. This disruption, in turn, could drive up prices across UK supermarkets and local shops, further straining already stretched household budgets.

Recent data already paints a concerning picture. Official figures show that in June, inflation unexpectedly climbed to 3.6 per cent. Fuel and food costs were among the main contributors. Meanwhile, retailers across the country have begun to sound the alarm. They report that hot and dry weather has sharply reduced the yields of fruits and vegetables. The price of chocolate has jumped, too, driven by poor harvests in West Africa. Coffee has followed a similar path, with erratic weather conditions slashing output in Brazil and Vietnam.

The Autonomy Institute drew on climate science, trade analysis, and economic forecasting to project the extent to which the problem could become far-reaching. With more frequent heatwaves and droughts on the horizon, the risks to global supply chains are mounting. That could lead to prolonged inflation, especially in everyday essentials.

Scientists continue to warn that the burning of fossil fuels is intensifying the climate crisis, making the UK more vulnerable to sudden floods and prolonged dry spells. With nearly half of all food consumed in Britain imported from overseas, households are exposed to shocks in international supply chains. Any disruption in countries like Spain, France, or Brazil can have swift ripple effects in the United States.

It’s not just global factors that are causing concern. Domestic agriculture is also under pressure. In 2023, UK vegetable production fell by 12 per cent due to a series of storms and floods.

The report warns that if global emissions remain unchecked, food prices in the UK could climb by 34 per cent by 2050. Even under a more optimistic scenario where global warming is capped at 1.5 degrees Celsius, food inflation could still hit 25 per cent.

The impact would not be felt evenly. Lower-income families, who already spend a larger proportion of their income on essentials like bread, meat, and rice, would bear the brunt of the increases. Autonomy estimates that heatwaves alone could add between £917 and £1,247 to the average household's food bill by 2050.

Without strong policy responses, the institute estimates that up to 951,383 more people could be plunged into poverty as a direct result of these price rises.

Will Stronge, chief executive of the Autonomy Institute, called on the government to act decisively. He proposed several targeted measures, including publicly funded diners to provide affordable meals for vulnerable communities. He also urged ministers to explore price controls and the strategic storage of essential goods to cushion the impact of supply chain shocks.

“Climateflation is no longer a distant risk; it’s a present reality,” Stronge said. “We need to build real economic resilience – and that means rethinking what public service provision can and should provide in the face of climate disruption: from delivery of basic essentials to publicly funded diners and a national buffer stock.”

Source

China floods: more than 30 killed in Beijing and tens of thousands evacuated

Authorities relocated 80,000 residents from China’s capital after registering rainfall of up to 543 mm in some districts