Your weekly guide to Sustainable Investment

TBLI Radical Truth Podcast

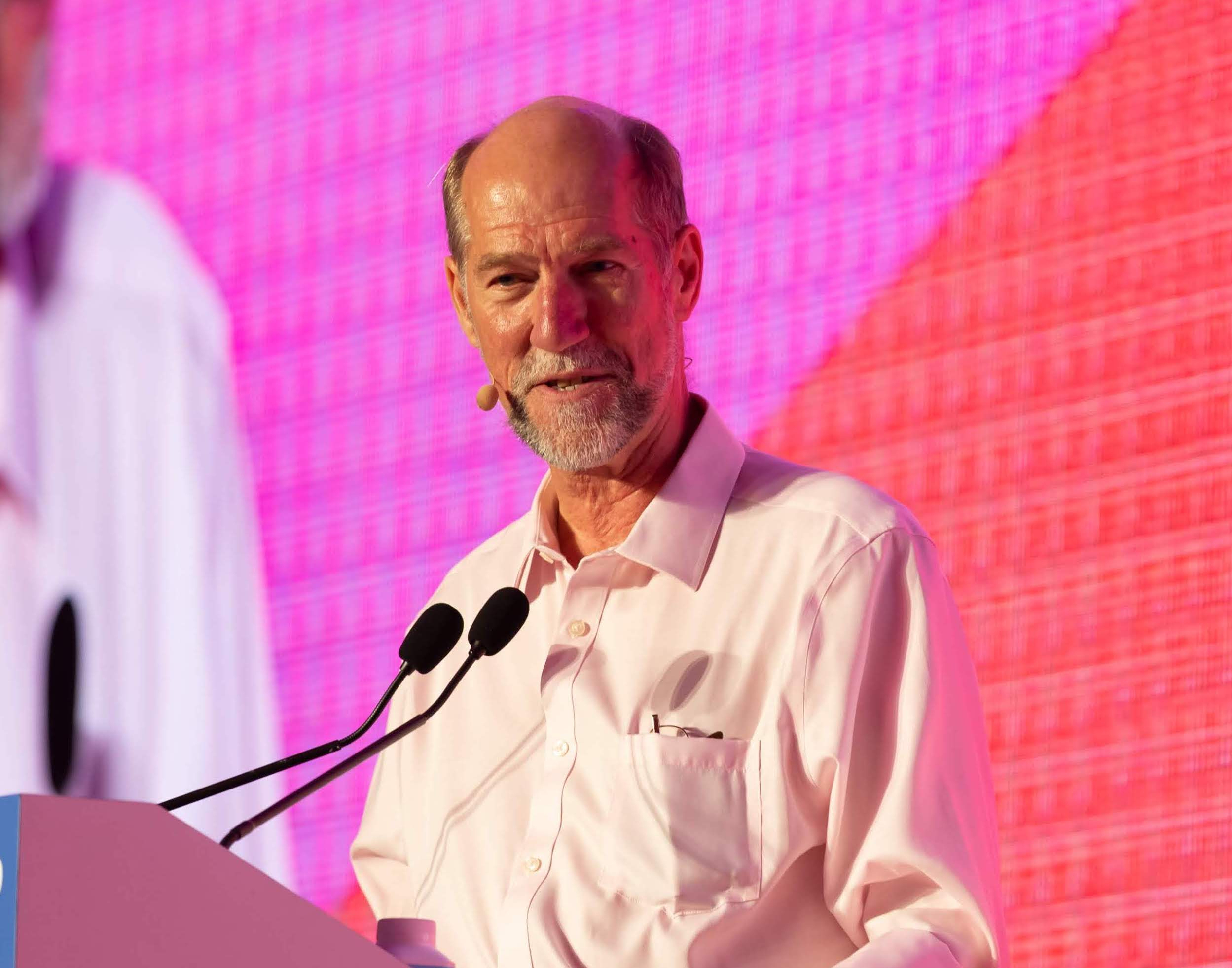

Faith in Action: Mobilising the World’s Largest Values-Based Investors /w Martin Palmer

Martin Palmer is the Chief Executive of FaithInvest. Previously, he was the Secretary General of the Alliance of Religions and Conservation (ARC), founded with HRH Prince Philip in 1995. ARC has closed and its legacy includes FaithInvest and WWF's International Beliefs and Values Programme.

Martin is an international specialist on all major faiths and religious traditions & cultures. He is the author and editor of more than 20 books on religious and environmental topics.

What you will learn:

- How religions became strong defenders of the environment, from the World Wildlife Federation's early interest, through the Alliance of Religions and Conservation organisation, to the 'ZUG Guidelines', FaithInvest, and beyond

- Encouraging signs of progress around the world: a Daoist approach in Hong Kong

- What's next? How Faiths can do more: moving beyond 'Good Intentions' to new frontiers through faith-inspired social development agencies

TBLI Virtual Mixer

TBLI Virtual Mixer Speed networking with values-aligned peers.

Our matchmaking system connects you No fluff. No travel. Just real, purpose-driven conversations.

Limited space — join early!

TrustVC

.jpg)

What if founders could rate investors, and LPs could spot red flags early? That’s the idea behind TrustVC.org, a new TBLI Group initiative bringing sunlight to startup funding. Why it matters:

Too many founders get ghosted. Too many LPs find out too late. TrustVC changes that by: Letting founders review VCs and PE firms Helping LPs identify trusted fund managers Highlighting fair, founder-friendly investors

How to support:

✅ Share TrustVC with your network

✅ Encourage founders to post reviews

✅ Add any missing firms

Just launched: TrustVC.org — the investor review platform VCs never wanted, but founders always needed.

If you’ve worked with investors, please leave a review or add a firm. Let’s bring some sunlight to startup funding

Join TBLI Circle and expand your Impact network

Join TBLI Circle — A Community Where Purpose Leads and Impact Grows

If you're tired of extractive networks, shallow conversations, or “impact” in name only, TBLI Circle is your antidote.

This is not just another platform. It’s a curated circle of professionals who believe finance should serve all stakeholders, not just shareholders.

Whether you’re in transition, seeking deeper alignment, or ready to collaborate on work that truly matters, TBLI Circle gives you something rare:

💬 Real relationships.

🌍 Shared values.

🤝 Trusted connections.

⚡ Momentum for your mission.

No ego. No greenwashing. Just people who care.

If you’ve been searching for the right room — this is it.

PHILANTHROCAPITALISM: WHEN BILLIONAIRES PLAY SAVIOR

How the Ultra-Wealthy Convinced Us They’re Saving the World

By: Robert Rubinstein

You know what I love about LinkedIn? It's where we all pretend that billionaires are our friends. Well, grab your coffee and your cognitive dissonance—we need to talk.

The Greatest Magic Trick Ever Pulled

So here's the setup: A guy spends 30 years crushing competitors, exploiting workers, and dodging taxes like they're radioactive. Then one day—POOF!—he's a philanthropist! He sets up a foundation, gets a tax write-off, and suddenly we're all supposed to applaud like trained seals because he's "giving back."

Giving back what? The money he took in the first place?

This is like a bank robber returning one dollar out of every thousand he stole and expecting a medal for his generosity. Except we actually give him the medal. And a tax deduction. And a Netflix documentary about his "inspiring journey."

The Holy Trinity of Billionaire Bullshit

These modern-day robber barons have convinced us of three sacred truths:

1. Billionaire Wisdom is Divine Because apparently selling software or exploiting user data automatically makes you an expert on education, healthcare, and world hunger. It's like saying, "I'm really good at Monopoly, so clearly I should redesign your entire neighborhood."

Think about it: When did being good at making money suddenly qualify someone to solve poverty? It's like asking a professional arsonist to redesign the fire department. The skills that make you ruthlessly effective at accumulating wealth—crushing competition, exploiting labor, avoiding taxes—are pretty much the opposite of what you need to create a just society.

2. Government is Too Stupid "Those elected officials are just too bureaucratic to solve problems," they say, while simultaneously lobbying those same officials to cut their taxes. It's beautiful, really. Create the dysfunction, then sell yourself as the cure.

Here's what they don't tell you: Democracy is supposed to be inefficient. It's supposed to involve debate, compromise, and listening to people who disagree with you. That's not a bug—it's a feature. But billionaires hate that messy process because it might lead to outcomes they don't control.

3. Business Thinking is Magic The quasi-religious belief that running a charity like a hedge fund will solve problems that have plagued humanity for centuries. "What poverty really needs is better metrics!" Sure, let's optimize human suffering like it's a supply chain.

They love talking about "disruption" and "innovation," but you know what would really be disruptive? Paying living wages. What would be truly innovative? Not hoarding wealth in the first place.

The Tax-Deductible Road to Hell

Here's my favorite part: We subsidize this whole charade. When Bezos "donates" to his own foundation, he gets a tax deduction. So the public treasury loses money while billionaires gain control over which problems get solved and how.

Let me walk you through this brilliant process:

- Make billions exploiting the system

- Set up a foundation (controlled by you, naturally)

- Get tax breaks for your "generosity"

- Use that foundation to shape policy benefiting your business

- Receive fawning media coverage as a visionary

- Watch inequality grow while everyone praises your philanthropy

The Language of Philanthropic PR

These billionaires have developed their own special language to make their power grabs sound altruistic. Let me translate some favorites:

- "Innovative approaches" = Applying business models to human suffering

- "Disruptive philanthropy" = Bypassing democratic processes

- "Strategic giving" = Donations that enhance their business interests

- "Impact investing" = Making money while pretending it's charity

- "Thought leadership" = Self-aggrandizing TED Talks about problems they helped create

- "Public-private partnership" = Privatizing public services while socializing the risks

This isn't accidental language. It's carefully crafted to sound forward-thinking while masking what's really happening: the concentration of decision-making power in unelected hands.

Real Talk About Motivation

Let's cut through the PR bullshit and talk about what really drives most philanthropic giving. It's not primarily compassion—if it were, these billionaires would just pay their taxes and support systemic change.

What drives philanthrocapitalism is a toxic cocktail of ego, control, and image management. These are people who genuinely believe their business success proves their superior intellect, not their superior access to capital, luck, and privilege.

When Zuckerberg announced he would "cure all disease," he wasn't being generous—he was feeding his messiah complex. When Musk focuses on Mars while Earth burns, he's not solving humanity's problems—he's indulging sci-fi fantasies with resources that could address actual suffering right here.

Read full article

Biochar from human waste could solve global fertiliser shortages, study finds

Excrement contains nutrients needed for crop growth and a new source of them could cut farming’s huge CO2 output

Asset Managers Positive On Sustainable Investing, Despite US ESG backlash

Isio, a UK provider of consulting, pensions administration, investment and wealth advisory services, has released a new survey showing that almost all asset managers have an established ESG policy in place.

Asset managers continue to raise the bar on sustainable investing, despite the recent ESG backlash in the US, according to the latest findings from Isio's Sustainable Investment Survey.

The survey reviewed more than 140 funds from about 65 UK-based asset managers. Isio found that 97 per cent of asset managers have an established ESG policy and sustainability teams in place, despite high-profile withdrawals from climate initiatives and concerns over fund labelling.

Isio’s research evaluates ESG integration across asset classes, exploring developments in investment approach, risk management, stewardship, reporting and collaboration, using its proprietary Sustainability Integration Assessments (SIAs). It found continued strong progress at firm level, but some inconsistencies in how ESG is embedded, evidenced and disclosed at fund level.

The findings are timely with the UK Department for Business and Trade currently consulting on draft UK Sustainability Reporting Standards, which closes next month.

Political pressures prompt exits from sustainability initiatives

Isio found that overall levels of ESG integration remain strong at firm level with more asset managers committing to the UK Stewardship Code (69 per cent in 2025 versus 65 per cent in 2024) and Net Zero plans (65 per cent in 2025 versus 58 per cent in 2024). However, due to rising political pressures, particularly in the US, there have been some withdrawals from other collaborative sustainability initiatives, with signatories to the Net Zero Asset Managers Initiative (NZAMI) decreasing from 63 per cent in 2024 to 57 per cent in 2025.

Reporting improves, but gaps remain in private markets

As demand for transparent and credible ESG disclosures increases, reporting practices remain under pressure. Just over half (54 per cent) of strategies assessed provided what Isio defines as sufficient fund-level reporting. Climate-related reporting has improved, with 41 per cent of funds aligned to Taskforce on Climate-related Financial Disclosures (TCFD). Social and nature-related disclosures continue to improve with 39 per cent and 17 per cent of funds meeting the benchmark in 2025 compared with 33 per cent and 11 per cent in 2024 respectively, however there is still significant room for improvement.

These gaps are particularly evident in private markets strategies, where data limitations and methodological inconsistencies are key challenges. Despite this, real assets are among the most advanced asset classes for sustainable and impact integration, reflecting the alignment between physical infrastructure and long-term ESG goals.

Managers row back from ESG objective-setting

ESG objective-setting has declined with 39 per cent of funds assessed adopting formal ESG objectives or focus areas in 2025, down from 49 per cent last year. This retreat may reflect increased regulatory scrutiny, evolving labelling regimes and firms wanting to avoid greenwashing claims. While integration is still a core objective, the decline in forward-looking ESG ambition suggests that some managers are taking a more cautious stance in a shifting policy environment.

Stewardship and risk management continue to evolve

Isio’s survey assessed how asset managers are incorporating ESG risks within investment processes. Many are now using multiple data sources and integrating ESG factors through scorecards or climate scenario modelling, particularly in active equity and real asset strategies. Three quarters of managers are using ESG scorecards and multiple data sources, up 2 per cent from 2024, while 62 per cent are conducting climate scenario modelling, up from 49 per cent in 2024.

However, within climate scenario modelling, it is still difficult to monitor how climate tipping points and systemic risks are captured within models.

“It’s encouraging to see that progress on sustainable investing continues, even in the face of a wider ESG backlash, particularly in the US,” Cadi Thomas, head of Sustainable Investment at Isio, said. “Most firms are holding firm on their commitments, and we’ve seen positive steps forward in areas like reporting and risk management, which are key foundations for long-term integration.”

“At the same time, there’s still significant work to do at fund level. Disclosures remain inconsistent, particularly in private markets, and while climate reporting has improved, social and nature-related data continue to lag,” Thomas continued. “Fewer funds are adopting formal ESG objectives, potentially driven by increasing labelling scrutiny. This shift suggests a more cautious approach, likely in response to growing regulatory pressure.

“With sustainability reporting now firmly on the Government’s agenda, now is the time to take stock and ensure strategies can stand up to increasing scrutiny,” Thomas added.

This has also been supported by other investment managers. Despite concerns that investors' appetite for ESG-focused investments is waning, Fannie Wurtz at French-based asset manager Amundi highlighted recently that there is still a lot of demand for it, notably in Europe. “Ninety per cent of EU institutional investors have ESG criteria in their Request for Proposal (RFP) and 30 per cent in Asia. It is paramount for EU investors,” she said.

Victoria Leggett, head of impact development at Union Bancaire Privée UBP, believes that the tide is starting to turn, adding that UBP’s Luxembourg-domiciled Biodiversity Restoration strategy has performed well this year. It is classified under Article 9 of the EU’s Sustainable Finance Disclosure Regulation (SFDR). She has seen a lot of interest in the fund from Scandinavian investors, in particular, as well as from UK and French investors. See here and here.

Source

Colorado deploys more than 1,000 firefighters to battle two huge blazes

Lee fire is one of largest blazes in state history after burning 130,000 acres, while Elk fire surpassed 14,000 acres

Firefighters in Colorado responding to one of the largest blazes in the state’s history are facing gusty winds and dry conditions that are expected to continue to drive extreme fire behavior.

More than 1,000 firefighters have been deployed, and while crews have gained containment on one fire, another has grown amid fire-friendly weather.

The Lee fire, churning through dry trees and brush about 250 miles (400km) away from Meeker, is now the fifth largest single fire in the state’s history, according to the Colorado division of fire prevention and control. The area has recently endured extreme drought conditions, and has “volatile” fuel loads, officials said.

The blaze, sparked by lightning on 2 August, had burned through more than 130,000 acres (52,000 hectares) by Monday morning and was just 7% contained. Low humidity and gusty winds were expected to return to the area, which combined with dry fuels, can cause extreme fire behavior, such as winds that carry embers over long distances and cause additional fires, officials aid.

Another major blaze in the region, the Elk fire, is burning to the east of the Lee fire, and has scorched more than 14,000 acres and is 30% contained. Officials have said containment has continued to increase and that crews are working to reinforce existing fire lines.

On Monday, the Colorado governor, Jared Polis, declared a disaster emergency to support response efforts for the Oak fire, which is burning in Pagosa Springs, Archuleta county.

Evacuations are in place for mountain communities across Garfield and Rio Blanco counties. On Saturday, the Rifle correctional center was evacuated “out of an abundance of caution”, the Colorado department of corrections said.

Smoke caused by the fires has prompted air quality warnings.

Meanwhile, in southern California, crews reached more than 90% containment on the Canyon fire that forced evacuations and destroyed seven structures after breaking out Thursday near the Los Angeles county and Ventura county line. Three firefighters have been injured in that blaze, including a battalion chief who was seriously hurt when his pickup truck rolled over in steep terrain.

The Gifford fire, California’s largest blaze so far this year, has scorched nearly 120,000 acres of Santa Barbara and San Luis Obispo counties since erupting on 1 August. It was 33% contained on Monday.

With months left before the highest fire risks subside, it has already been an explosive year for fire across North America. Nearly all available firefighting resources are deployed in the US, as 36 large fires actively burn across the country.

In Canada, hundreds of wildfires continue to burn out of control and the country is seeing its second-worst fire season on record. More than 18m (7.3m hectares) has been scorched – nearly 78% more than the five-year average, according to data from the Canadian Interagency Forest Fire Centre (CIFFC).

“This is our new reality … the warmer it gets, the more fires we see,” Mike Flannigan, the BC research chair for predictive services, emergency management and fire science at Thompson Rivers University in Kamloops, told the Guardian.

The climate crisis has intensified conditions that fuel fires, setting the stage for easier ignitions, rapid growth, and hotter, catastrophic burns that are more challenging to contain

read full article

Colo. Prison Evacuated As Wildfire Becomes One Of Largest In State History

The Lee Fire has charred more than 167 square miles and is just 6% contained.

MEEKER, Colo. (AP) — A Colorado prison was evacuated as one of the largest wildfires in state history continued to grow, and officials warned residents of remote areas to be ready to leave Sunday as gusty winds and low humidity fed the flames.

Evacuation orders were already in place for mountain communities as the Lee Fire charred more than 167 square miles (433 square kilometers) across Garfield and Rio Blanco counties, with just 6% containment. No injuries or structural damage has been reported.

All 179 incarcerated people were safely removed from the Rifle Correctional Center on Saturday “out of an abundance of caution,” the Colorado Department of Corrections said in a statement. They were temporarily relocated about 150 miles (240 kilometers) away to the Buena Vista Correctional Complex, the department said.

The Lee Fire, churning through trees and brush about 250 miles (400 kilometers) west of Denver, is now the sixth-largest single fire in the state’s history, according to the Colorado Division of Fire Prevention and Control.

More than a thousand firefighters are battling the blaze, working to keep the flames to the west of Colorado 13 and north of County Road 5, officials said.

Health officials issued air quality warnings related to smoke from the Lee Fire and the 23-square-mile (60-square-kilometer) Elk Fire burning just to the east.

In Southern California, crews reached 62% containment on the 8-square-mile (20-square-kilometer) Canyon Fire that forced evacuations and destroyed seven structures after breaking out Thursday near the Los Angeles County and Ventura County line. Three firefighters have been injured, including a battalion chief who was seriously hurt when his pickup truck rolled over in steep terrain.

The Gifford Fire, California’s largest blaze so far this year, has scorched at least 180 square miles (466 square kilometers) of Santa Barbara and San Luis Obispo counties since erupting on Aug. 1. It was 21% contained on Sunday.

Source

https://mail.tbligroup.com/emailapp/index.php/lists/vr9326mjcm0e8/unsubscribe