Your weekly guide to Sustainable Investment

TBLI Radical Truth Podcast

Beyond Lawyers and Term Sheets:

Reinventing Startup Finance /w Anthony Rose

In this episode, we’re joined by Anthony Rose, co-founder and CEO of SeedLegals, the platform that has become the UK’s largest closer of startup funding rounds. Often called “the man who saved the BBC iPlayer”, Anthony has a track record of building technology that transforms industries. With SeedLegals, he’s now disrupting one of the most complex and outdated spaces of all: startup fundraising and legal processes.

In “Beyond Lawyers and Term Sheets,” Anthony shares how technology is replacing expensive, slow, and opaque legal negotiations with a streamlined, transparent, and founder-friendly approach. We’ll explore how SeedLegals is democratizing access to capital, reducing friction for investors, and giving entrepreneurs the tools to focus on building businesses—not battling paperwork.

TBLI Radical Truth brings you candid conversations with the people reshaping finance

Listen to the full podcast

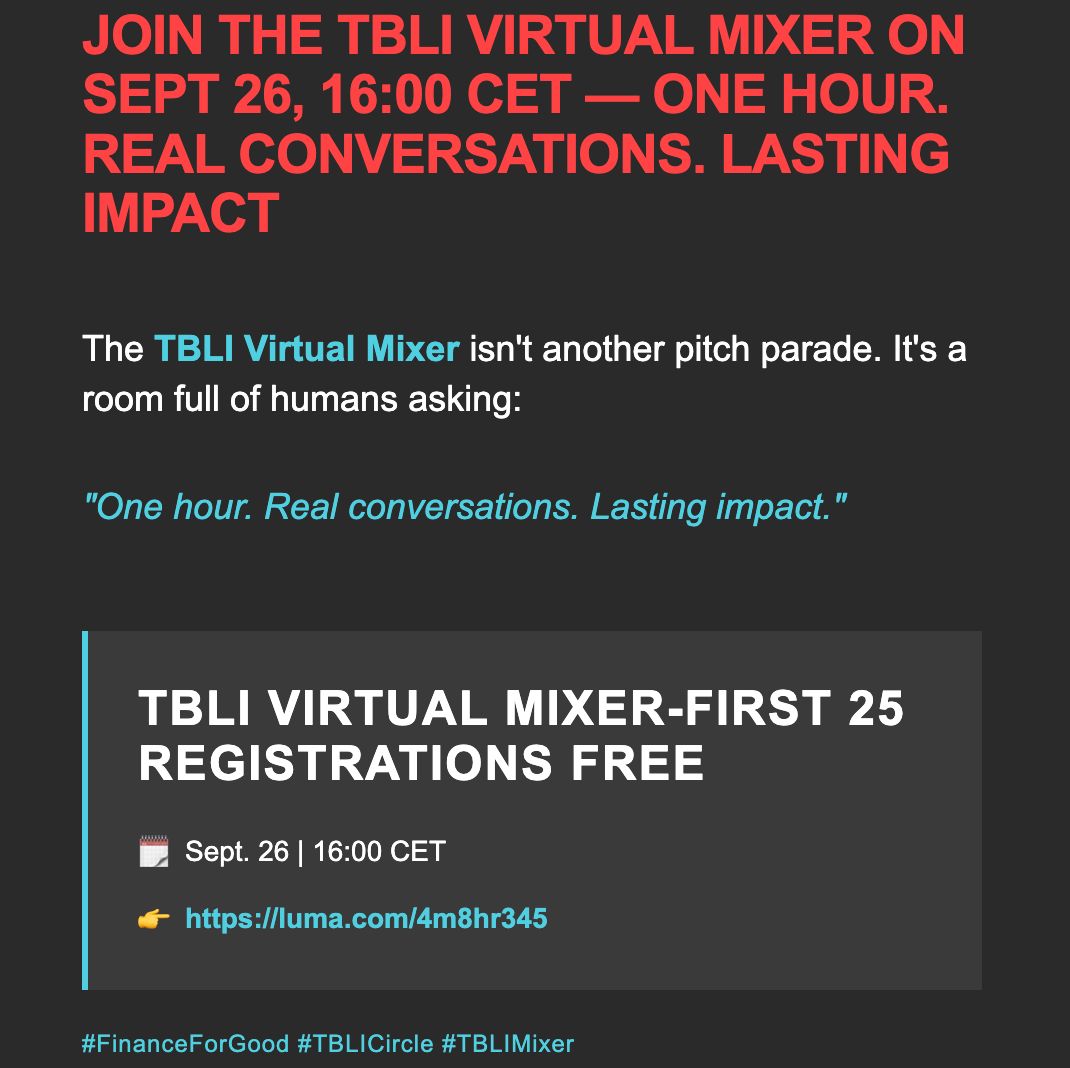

TBLI Virtual Mixer