Your weekly guide to Sustainable Investment

TBLI Circle

Watch TBLI Circle intro video

Join TBLI Circle, the paramount community for sustainability enthusiasts. Immerse yourself in a dynamic network that resonates with your values and commitment to sustainable practices. With exclusive events and networking opportunities, TBLI Circle empowers and brings together individuals dedicated to shaping a sustainable future. Don't miss out—join now and thrive within your sustainability tribe!

Limited-Time Deal: Explore TBLI Circle with a Complimentary 2-Week Trial!

Upcoming TBLI Events

Sunak faces anger over gas-power strategy for ‘backing up renewables’

PM says he will not gamble on energy security, in move likely to be seen as backwards step in decarbonising network

Rishi Sunak risks further criticism from green campaigners after throwing his weight behind the building of new gas-fired power stations, saying he will “not gamble with our energy security”.

The government will on Tuesday announce a plan to increase gas power capacity by providing extra certainty to investors that plants have a long-term future, even as Britain moves away from fossil fuels.

Ministers said it represented a “commonsense decision” to ensure power supplies kept flowing during the transition to net zero. They argued that gas plants were a “safe and reliable source” when weather conditions did not power wind and solar farms.

The government stressed that the move would not impact net zero targets. However, critics are likely to see it as a backwards step in the wider push to decarbonise Britain’s power network through renewable energy projects. Some big energy firms have deserted the gas industry in recent years to focus on renewables, which have a more certain future.

Last year, gas accounted for 32% of Great Britain’s electricity generation, ahead of 29% from wind and 14% from nuclear. The last remaining coal-burning plant, at Ratcliffe-on-Soar in Nottinghamshire, is due to close in September.

Renewable industry backers argue that investment in battery projects – which can store electricity when weather conditions are unfavourable – is vital to make the system more reliable.

The energy secretary, Claire Coutinho, is expected to set out her strategy for gas at a speech at the thinktank Chatham House in central London on Tuesday.

“Without gas backing up renewables, we face the genuine prospect of blackouts. Other countries in recent years have been so threatened by supply constraints that they have been forced back to coal,” she will say.

“There are no easy solutions in energy, only trade-offs. If countries are forced to choose between clean energy and keeping citizens safe and warm, believe me they’ll choose to keep the lights on.”

Jess Ralston, an energy analyst at the Energy and Climate Intelligence Unit thinktank, said: “The secretary of state suggesting that if we cannot control energy prices then we are not secure as a country, while announcing new gas power stations, has a real irony about it.

“Anyone paying an energy bill in the past two years knows that the UK doesn’t control the price we pay for gas, that international markets decide.”

Energy security has shot up the political agenda since Russia cut gas exports into Europe after Vladimir Putin’s full-scale invasion of Ukraine in 2022, leaving countries scrambling to secure supplies and household bills soaring.

Sunak said: “We need to reach our 2035 goals in a sustainable way that doesn’t leave people without energy on a cloudy, windless day. I will not gamble with our energy security.”

The prime minister’s intervention appears to be his latest attempt to win votes by pushing back on green policies. The switch to green power has also become a contentious political point, with the Conservatives pledging to decarbonise power generation by 2035, and Labour by 2030.

Both parties envisage gas-fired plants will play a small part in providing back-up power supplies even after those dates, as Britain prepares for a surge in electricity demand despite recent delays to renewable and nuclear projects.

The shadow energy secretary, Ed Miliband, said: “Of course we need to replace retiring gas-fired stations as part of a decarbonised power system, which will include carbon capture and hydrogen playing a limited back up role in the system.

Read full article

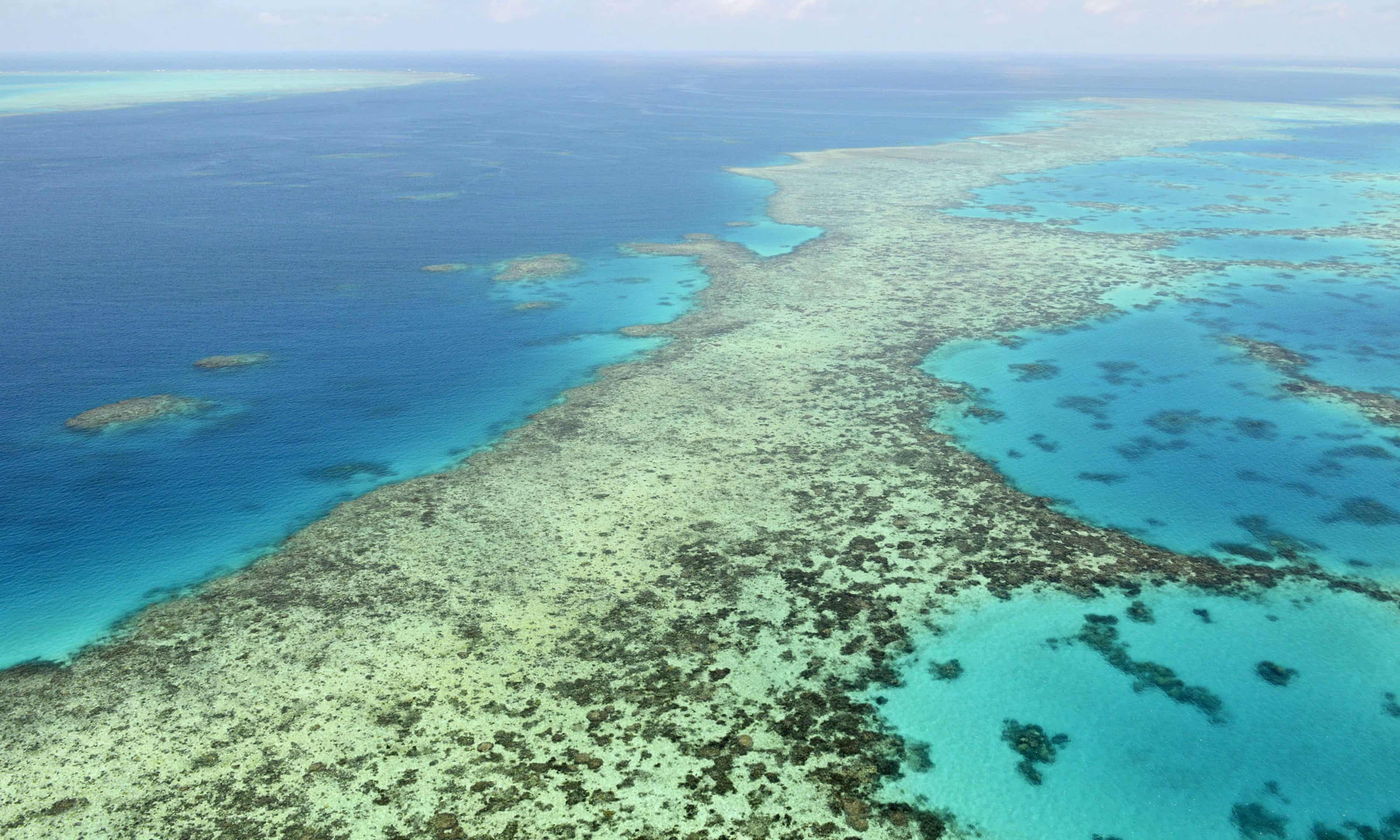

Almost half of cane growers sceptical of science behind laws protecting Great Barrier Reef

Review found ongoing ‘mistrust’ among farmers, including many who remain unconvinced by need for pollution regulations

A review of the Queensland government’s Great Barrier Reef protection regulations has found that almost half the affected farmers still believe there is little or no scientific evidence to support pollution reduction rules.

The laws, passed in 2019, were based on scientific advice that limits on sediment and chemical runoff were needed in the reef catchment, amid concerns about water quality.

Some opponents of the laws – including groups representing cane growers and graziers – at the time sought to discredit the consensus science, including by backing a speaking tour of north Queensland by the contrarian scientist, Peter Ridd.

A review of the regulations published last week found that the combined effect of the regulations and other programs had resulted in positive “practice change” in the agriculture sector within the reef catchment. Data shows compliance rates improving across the catchment.

But the review also raised concern about ongoing “scepticism, mistrust [and] resistance” among farmers, including many who remain unconvinced by the need for the regulations.

There remains concern within farming communities, including that some requirements were “confusing” or “vague and contradictory”, and that record-keeping requirements had been costly and time-consuming.

Stakeholder consultation undertaken as part of the review found that many farmers still did not accept the science.

“Some respondents expressed scepticism about the science and data underpinning the reef regulations and the relationship between practice change and water quality, or whether the reef was at risk at all, leading to doubt about the need for the reef regulation,” the review found.

A survey found 40% of respondents believed the evidence for the regulations was “weak” and that 7% thought there was no evidence. Only 5% believe there was “strong evidence” to back the regulations.

Sugar cane (61%) and grain producers (57%) were the most likely to believe evidence was weak.

“Stakeholder feedback, particularly from sugarcane producers, suggested that mistrust in government may present as a barrier to compliance and may be further fuelled by disbelief in the underpinning rationale for the reef regulations,” the review found.

The review also noted significant concerns about compliance activities and that the government had made changes to its compliance program as a result.

“Some respondents … felt that their practices (and constraints) are not well understood by the department and compliance officers, and as a result feel they must justify and explain their operations,” the review found. “It was suggested this has resulted in losing confidence in the process and regulations.”

Water quality is considered the second most serious threat to the health of the reef – after global heating.

Last week, the Great Barrier Reef marine park’s government authority confirmed the another mass coral bleaching event driven by global heating – the fifth in only eight years.

Source

California’s polluted communities could miss out on billions under state’s flawed system

This story was originally published by CalMatters.

Researchers found that the state's screening tool uses a small number of health problems that could bias which communities are designated.

The system that California uses to screen neighborhoods at risk of environmental harm is highly subjective and flawed, resulting in communities potentially missing out on billions of dollars in funding, according to new research.

The study, by researchers who began the project at Stanford University, investigated a tool that the California Environmental Protection Agency developed in 2013 as the nation’s “first comprehensive statewide environmental health screening tool” to identify communities disproportionately burdened by pollution.

Communities that are designated “disadvantaged” by the system, called CalEnviroScreen, can qualify for significant government and private funding. The tool has been used to designate vast swaths of the Central Valley, communities around the ports of Long Beach and Los Angeles, and neighborhoods in the Bay Area cities of Richmond and Oakland, among others.

The researchers found that the screening tool uses a small number of health problems that could bias which communities are designated. About 16 percent of Census tracts in the state could be ranked differently with alterations in EnviroScreen’s model, according to the study.

The system raises equity issues because it biases in favor of certain groups over others, and has the potential of pitting groups against each other for funding in what is essentially a winner-take-all, or loser-take-all, system, according to the research.

For instance, “we found the existing model to potentially underrepresent foreign-born populations,” the researchers wrote.

Community groups and environmental justice advocates have said for years that the tool overlooks communities that should be designated as disadvantaged.

At stake is a large amount of funding — about $2.08 billion over just a recent, four-year period, the researchers reported.

The findings come as scientists are increasingly demonstrating that algorithms can be as biased as the humans who create them, and that many disproportionately harm marginalized populations.

“The big takeaway is that if you asked ten different experts in California to come up with their own screening algorithm to determine which neighborhoods are ‘disadvantaged,’ you would probably get 10 very different algorithms,” said lead author Benjamin Huynh, who was a doctoral student at Stanford and is now a researcher at Johns Hopkins University. “These things can come across as very technical, but when you look at the numbers and you see the billions of dollars flowing … these very seemingly technical details actually matter a lot.”

Amy Gilson, a spokesperson for CalEPA’s environmental health office, said the study’s recommendations are being reviewed. Any potential changes to CalEnviroScreen must “go through a robust scientific evaluation” as well as “extensive public process,” she said.

“CalEnviroScreen’s methods are transparent to allow for these types of outside evaluations, and we welcome discussion on the merits of different approaches,” Gilson said in an emailed statement to CalMatters.

Read full article

The trouble with voluntary carbon markets

How asset managers and investors can identify legitimate carbon assets

The voluntary carbon-credit market has recently come under fire for selling “junk” carbon offsets that don’t actually provide additional emissions cuts, have exaggerated claims or inflate baseline calculations. Analysis from U.K.-based The Guardian found that 78% of emission offset projects were “likely junk,” with the rest either “potentially junk” or of undetermined efficacy.

“This type of news is impacting the confidence of investors on anything that has to do with responsible investments,” said Deborah Debas, a responsible investment specialist with Desjardins Wealth Management in Longueuil, Que.

Carbon offsets offer credits to counter carbon emissions ton for ton, and are retired permanently after use. They are one way for a company to become carbon neutral. Investment firms also have used carbon credits to offset their investment portfolio’s carbon footprint.

Carbon credit markets fall into two categories. Mandatory or compliance markets, such as the cap-and-trade programs of Quebec and California, treat tradable carbon credits as a commodity capped at a certain volume per year. The second kind of markets — voluntary — have fewer restrictions.

The stringency of mandatory carbon markets can be a double-edged sword. Mandatory markets have complicated guidelines that often make only larger projects viable due to the administrative effort required, said Olaf Weber, professor and chair, sustainable finance, with York University’s Schulich School of Business.

Furthermore, many mandatory markets work only within their own jurisdiction, whereas credits from voluntary markets can be traded globally, said Eric Cooperström, managing director of impact investing and natural climate solutions, timberland and agriculture, with Manulife Investment Management Ltd.

The voluntary market provides more flexibility, but Weber said it needs to meet more rigid standards to build investor trust.

“The conversation and the scrutiny over the last several years really underscores the importance of having a focus on quality and integrity,” he said.

Independent verification also could increase trust. Forest carbon-offset protocols, which quantify greenhouse-gas emissions reduction by forests, have been around for more than two decades, but became popular only in the past several years, Cooperström said.

One agency that conducts these analyses is the Integrity Council for Voluntary Carbon Markets (ICVCM), an independent organization that designed a set of minimum rules for the voluntary carbon market in 2023. Manulife’s carbon principles are aligned with the ICVCM’s, Cooperström said.

Although voluntary carbon registries have differing project assessment standards across markets, they are beginning to collaborate more closely to adopt uniform guidelines. “I think we’ll see a convergence of standards and practices and, ultimately, a simplification of what has historically been a very fragmented market,” Cooperström said.

The ICVCM’s key criteria include permanence monitoring for at least 40 years, proving that carbon offsets are truly voluntary and additional, and ensuring rigourous baseline setting — ways investors can identify legitimate carbon assets, he said.

Investors also should look for projects that ensure carbon credits are additional — for example, that trees would not have been planted were it not for the project, Debas said. The carbon credits from a project also should be unique, meaning that the credit is permanently retired after use and not double-counted. And projects should not cause displacement, such as deforestation occurring on a site adjacent to the one being preserved.

Read full article