Your weekly guide to Sustainable Investment

TBLI Capital Connect

Your Gateway to Mission-Aligned Investors

Why TBLI Capital Connect?

✅ Access to a curated network of high-net-worth investors and venture capitalists

✅ Tailored matchmaking to align you with the right funding partners

✅ Streamlined process to fast-track your fundraising goals

✅ Different tiers of service, offering you the most suitable service according to your budget.

More details here

Would you like to book a call to discuss in detail? click here

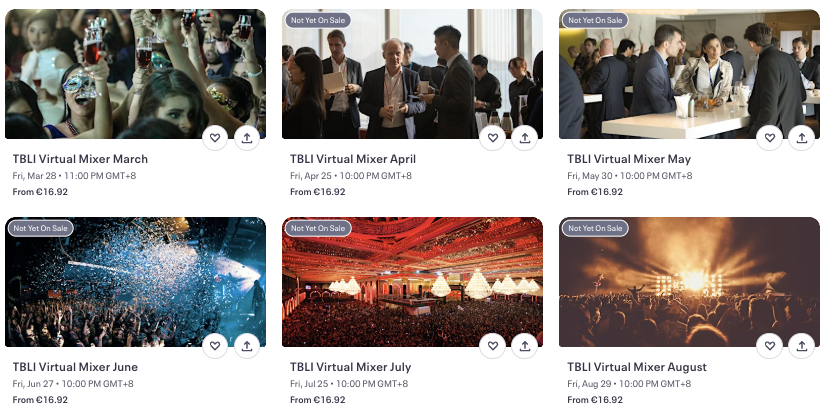

Upcoming TBLI Virtual Mixers

TBLI Radical Truth Podcast

Funding High-Impact Solutions for Basic Needs /w Kevin Starr

Kevin Starr leads the Mulago Foundation. Mulago finds, funds, advises and promotes organizations with scalable solutions to poverty.

Mulago’s two fellows programs teach early-stage social entrepreneurs how to 1) design for maximum impact and 2) build strategies for maximum scale.

Most fellows become part of the Mulago Solutions portfolio, which provides unrestricted funding as long as there is impressive progress toward impact at scale.Kevin started out in medicine and practiced until founding Mulago.

He and his team now work with 50 portfolio organizations, many of which have become leaders in the social sector, along with 40 fellows leading organizations in Africa, South Asia, and South America

What will you learn?

- What is a high-impact organization?

- Can you achieve true impact with few restrictions for the grantee?

- Which is more effective grant or an investment?

Join TBLI Circle and expand your Impact network

Step into a community of purpose-driven professionals transforming finance for a sustainable future. At TBLI Circle, you’ll connect with authentic leaders, discover breakthrough opportunities, and gain insights that drive real impact. Expand your network, elevate your influence, and accelerate your journey in ESG and impact investing. Don’t just talk about change—be the change.

Expand your network, elevate your influence, and accelerate your journey in ESG and impact investing. Don’t just talk about change—be the change.

Carbon Dioxide Removal Must Be Scaled Responsibly. But What Does That Mean?

Carbon dioxide removal (CDR) has grown from a little-known concept to a fast-growing field in the last several years. Beyond the climate benefits from removing carbon dioxide (CO2) from the atmosphere, many CDR approaches may also benefit people and the environment, like creating jobs to boosting soil health or reducing local ocean acidification. However, CDR projects can also come with unintended consequences or negative impacts, so robust governance frameworks must be in place to minimize any damages.

Comprehensive and fit-for-purpose governance frameworks are needed, for example, so that oil and gas industries don’t rely on CDR to justify their continued fossil fuel production. These frameworks can also help protect communities that already face increased pollution and harm from the fossil fuel industry from additional risks tied to land, water and energy use that may come from these new CDR facilities.

As the carbon removal industry ramps up, there is a growing emphasis on “responsible” carbon removal to ensure communities don’t experience harm and have access to local benefits. But what does this mean concretely? In the context of ensuring robust governance, what can be done to improve policy and regulation to deliver responsible outcomes?

Here, we answer some of these questions.

What Does Responsible Carbon Removal Entail?

Responsible carbon removal emphasizes the importance of sustainably and safely deploying a range of CDR approaches that use chemicals, rocks, biomass, soils, the ocean and more to complement efforts to drastically reduce greenhouse gas emissions without exacerbating any historical harms to communities or the environment.

At a project level, this includes thoroughly assessing the social, economic and environmental impacts of CDR projects and minimizing negative effects while equitably distributing benefits. At a policy level, it entails the creation of policies and regulations that ensure that CDR contributes to real climate benefits, while protecting communities and ecosystems.

Achieving responsible carbon removal therefore requires robust governance to minimize these trade-offs. In addition to its global climate benefit, it must deliver local tangible benefits like improvements to air quality or revenue to invest into communities and ecosystems rather than exacerbate inequities or environmental harms of other industries. It must also entail inclusive decision-making and complement — not substitute — ambitious emissions reductions.

Without public trust and community support, CDR projects may struggle to gain any social license and scale, limiting their ability to contribute to climate goals. For instance, other clean energy projects that did not adequately engage communities have faced delays or cancellations. Ensuring responsible implementation by industry and governments is therefore key to building that trust.

Key Questions to Inform Responsible CDR Policy

Below we answer three key questions about the role of policymaking to ensure the responsible deployment of CDR.

How Can Policies Ensure that CDR Maximizes its Benefit to the Climate?

Scientific consensus is clear: Removing carbon dioxide from the atmosphere will be necessary to complement efforts that drastically reduce greenhouse gas emissions by mid-century to prevent further unprecedented warming across the Earth. There are however various concerns (including from academics and NGOs), ranging from the risk of delaying emissions reductions, to the need for more accurate measurements of projects’ net climate benefits. Some policy measures and safeguards can help address these risks:

Setting Separate Targets

Without adequate policy measures in place, scaling CDR in the next decades could risk shifting focus and resources away from the urgent need to reduce emissions today and transition away from fossil fuels. This risk is known as mitigation deterrence.

Separate long-term climate targets for emissions reduction and CDR can help address this risk, with some U.S. states, like California and Washington, providing early examples. This might be more easily achieved in states or countries with net-zero policies and greenhouse-gas reduction mandates, through which the role of CDR can be responsibly defined.

Under this approach, CDR is planned and accounted for separately based on a quantitative assessment of expected residual emissions. This clarifies how much CDR is planned to reach net-zero, ensuring transparency and preventing CDR from being misused to offset emissions that could instead be reduced.

Policymakers must refrain from planning for CDR to sustain fossil fuel use, which would undermine emissions reduction efforts and risk derailing climate targets. Emitting CO2 now and removing it later does not prevent its consequences: CO2 emissions cause irreversible climate damage, which CDR cannot undo.

Scaling CDR will also be constrained by sustainability limits on land, water and energy availability as well as societal impacts.

Lastly, CDR technologies are still largely in development. There is uncertainty as to the extent to which they will scale in the coming decades. Relying on the promise of a massive scale up to address residual emissions is therefore risky, highlighting the need to rapidly reduce emissions to the maximum extent possible.

Read full article

Ed Miliband vows to engage with China on climate after Tory ‘negligence’

Energy security and net zero secretary travels to Beijing for countries’ first formal climate meetings since 2017

Ed Miliband has accused the previous Conservative government of negligence for failing to engage with China on climate issues, as he travelled to Beijing for the countries’ first formal climate meetings since 2017.

The secretary of state for energy security and net zero was in Beijing to announce a new annual UK-China climate dialogue. The first summit will take place in London later this year. China’s minister of ecology and environment, Huang Runqiu, is expected to attend.

The dialogue “is an essential start to putting an end to what I call the previous strategy of negligence”, Miliband said. He said the new annual summit represented “a strategy of committed engagement”.

The dialogue will allow ministers and officials to share experiences on issues such as energy market reform, carbon capture and storage, domestic climate goals and other issues related to the clean energy transition. It will be the first regular dialogue to be held at secretary of state level.

Miliband stressed that “the world is way off track from where we need to be” before the Cop30 UN climate summit in Brazil in November. He said that in his first eight months as secretary of state, he had visited Brazil, India and China, showing that “Britain is back as a climate leader” on the world stage. The UK is hoping to shape a new global axis in favour of climate action along with China and developing countries, to counter Donald Trump’s abandonment of green policies in the US.

Asked about how Britain could show leadership on sensitive areas in China’s energy transition, such as human rights, Miliband declined to give details.

Campaigners have highlighted that nearly half of the world’s solar-grade polysilicon, a crucial raw material for solar panels, comes from Xinjiang, a region of China where there are credible reports of forced labour for Uyghurs and other minorities via “surplus labour” programmes in which workers are transferred to work in other parts of the country. China says the labour initiatives are voluntary and aimed at tackling poverty.

Miliband said: “The issue of forced labour is absolutely something I’ve raised and it is a concern in the UK … I raised it with my Chinese hosts.” He said China “will continue to play a really important role in solar production”.

The government’s massive investments in the solar industry mean that China dominates about 80% of the total supply chain, with western leaders concerned about oversupply driving down prices.

Miliband also addressed the issue of coal phase-out in China. Despite the country’s huge rise in clean energy production, Beijing remains committed to coal, and recently pledged “increase coal production and supply capacity” to ensure energy security.

“We obviously want China and all countries indeed to move away from fossil fuels,” Miliband said. He said that he believed the Chinese side “sees renewables as the kind of driver of the system” and fossil fuels as the “underlying backup”.

Source

Trump repeals America’s first-ever tax on greenhouse gases before it goes into effect

The methane fee would have had the same impact as taking 8 million gas-powered cars off the road.

In late February, Republicans in the House and Senate voted along party lines to repeal a Biden-era rule implementing a federal tax on methane pollution. President Donald Trump signed the measure into law on Friday — putting the country’s climate goals further out of reach. Since taking control of the White House and both chambers of Congress this year, Republicans have set about systematically dismantling Biden-era advancements on climate change, no matter the size or projected economic impact of the policy, with varying degrees of success.

Methane is a powerful but fast-acting greenhouse gas — it packs a big punch in the short term and weakens over time. Studies show methane is responsible for 20 to 30 percent of global warming since the Industrial Revolution. U.S. oil and gas operations are collectively responsible for emitting more than 6 million metric tons of methane every year — the equivalent of 10 percent of the country’s annual CO2 emissions, if you’re looking at a greenhouse gas’s first 20 years in the atmosphere. Methane is the primary component of natural gas, which often leaks out of drilling sites, pipelines, and storage facilities.

When Joe Biden was elected president in 2020, he made it clear that he intended to become the first president in American history to successfully take on climate change — a goal that necessarily included targeting methane emissions. In 2022, he signed the Inflation Reduction Act, or IRA — legislation that offered hundreds of billions of dollars in incentives, loans, and grants to households, utilities, and industries to cut their greenhouse gas emissions.

The IRA also amended the Clean Air Act to include a provision that directed the Environmental Protection Agency to establish a methane fee for major producers of oil and gas — essentially, taxing fossil fuel companies for every ton of the greenhouse gas they emitted above a certain threshold. The legislation included subsidies to help producers who emitted methane over the legal limit to install gas-trapping technology to reduce their emissions.

The rule the EPA finalized in November last year, technically called the Waste Emissions Charge, would have applied to facilities that produce volumes of methane that exceed the equivalent of 25,000 tons of carbon dioxide. The fee started at $900 per ton of methane in 2024 and would have risen to $1,200 per ton in 2025 and $1,600 in 2026 and every year beyond that. Most big oil and gas companies already meet the standards laid out in Biden’s fee, which means they wouldn’t have had to pay anything. The EPA was supposed to start tallying up fees this year based on 2024 emissions data, but Republicans repealed it before the agency could start collecting penalties.

The fee, had it taken effect, would have been the first-ever federal tax directly imposed on a greenhouse gas. It would have applied to roughly a third of the methane emissions that come from oil and gas infrastructure in the U.S. and diverted 1.2 metric tons of methane through 2035 — the equivalent of taking nearly 8 million gas-powered cars offline for a year.

Shell, BP, and other oil majors supported the initiative. But other parts of the oil and gas industry, and Republicans in Congress, opposed it.

“No one wants to do business when the federal government creates regulations that will put them out of business, which is what this natural gas tax is doing,” said Republican August Pfluger of San Angelo, Texas, the Congressman who wrote the measure that Trump signed on Friday. Pfluger’s district overlaps with the Permian Basin, the highest producing oil field in the U.S. “In reality this rule has only stifled American energy production, discouraged investment, and increased energy prices across America,” he said.

Pfluger’s pessimistic view of the health of America’s oil and gas industry is at odds with what official reports say. America’s fossil fuel producers are on a winning streak by every measure. The U.S. is the largest exporter of natural gas in the world, and crude oil and natural gas production hit record highs in December. The Texas oil and gas industry broke new production records on Monday.

“It’s hard to imagine how a country that’s breaking records for production is being somehow constrained,” said Jon Goldstein, associate vice president of the Environmental Defense Fund’s energy transition program. “I don’t think that argument really holds water.”

However, the tax tackled only a sliver of U.S. methane emissions. The American agricultural and waste sectors produced almost twice as much methane as fossil fuel production between 2010 and 2019. But clamping down on emissions from those sectors is challenging. Methane emissions from agriculture come from myriad decentralized sources, like cows and manure storage facilities, making them difficult to regulate. And the amount of methane agriculture produces depends in large part on consumer eating habits, which are hard for the government to control.

Read full article

How the next generation will reshape impact investing

A staggering $84 trillion in wealth is expected to be transferred to younger generations in the next two decades.

I’ve had the good fortune of spending a large part of my adult years in the company of younger people. I’ve raised a son, coached sports, taught university investment classes and run a NexGen-centric network non-profit for three years. Did I mention I also ran a hip-hop record label, too?

My point is that I’ve been close to young people on the verge of influence for most of my life. And for all the anxiety around the current politicization of how we invest, the truth is most of it is largely in their hands.

The next generation, which I define as Gen Z and Gen Alpha, already are current consumers, current or future employees, and are well on their way to becoming leaders and investors. They have a huge influence on all facets of society, particularly when it comes to money.

A staggering $84 trillion in wealth is expected to be transferred to younger generations in the U.S. through 2045, according to consulting firm Cerulli Associates. For context, this “Great Wealth Transfer” is almost as much as global GDP was in 2022 ($101 trillion). Approximately $30 trillion of that will be inherited by women in the next decade alone.

The changing face of impact investing

The roots of impact investing began when people passionate about fomenting solutions to social injustices and climate risks figured out there was a market for profit capital to help advance their causes. Leaders from this “do good” place realized that rather than philanthropic giving, a business and profit motive behind investment in solutions that benefited people and the planet might catalyze significantly greater resources needed to make a difference.

As the cottage industry of impact investing became a larger ecosystem, historic leadership in the space needed to backfill the financial and technical talent needed to structure and manage the investments, and construct market-acceptable terms and vehicles to attract, keep and manage the capital flowing into the space. The new recruits were veterans of “traditional” investment backgrounds, wizened in the ways of financial products and markets. They came to this intersection of doing well and doing good from the “do well” world.

But recent and upcoming practitioners and investors are of generations that don’t distinguish among these worlds. Between increasing impact investing courses at business schools and colleges, and a deluge of media surrounding climate change, NexGen investors perceive the magnitude of impact investing opportunities. They’re sophisticated in both issues of people/planet and the capital markets. The result is a predisposition to action and urgency.

The NexGen influence

One of the most important ways current leaders and those with influence and power can hasten change is by helping young changemakers find their way to their own influence and power. As these opportunities unfold for them, here is how their influence will reshape the direction of impact investing:

- Fewer biases: The next generation of investors and practitioners will lack the biases around investing for transition, resilience and impact. Incessant debates over “isn’t impact investing concessionary” isn’t a point of discussion because NexGen investors and practitioners are conversant in the continuum of risk-adjusted returns – from venture capital to public markets to grants and donations to catalytic investment with objectives to facilitate “crowding in” others.

- Values-based approach: Gen Z and Gen Alpha are more likely to align their investments with their personal values, particularly emphasizing climate/earth resilience and social justice. A Stanford Graduate School of Business survey found that the average investor in their 20s or 30s was willing to lose between 6 percent and 10 percent of their investments to see companies improve their environmental practices, compared to the average baby boomer unwilling to lose anything. Further, the notion of “impact” is beginning to evolve. Students I work with each year come up with a vastly more robust list of issues of people and planet such as trust in institutions, veracity of media, holistic medicines, and rights to work in an AI future. These ideas of impact go way beyond the United Nations’ 17 SDGs (a favorite framing of impact for managers), which were written in 2015.

https://mail.tbligroup.com/emailapp/index.php/lists/cm138dw4qa9f1/unsubscribe