Your weekly guide to Sustainable Investment

Finance isn’t broken—it’s just misaligned. Realign it with us.

Support TBLI→ tbli.org

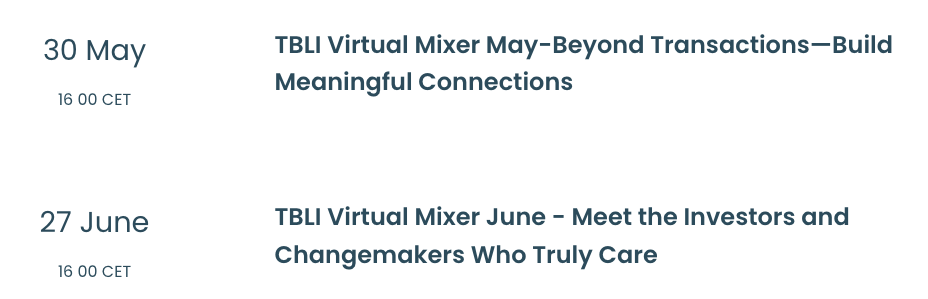

Upcoming TBLI Virtual Mixers

Join TBLI Circle and expand your Impact network

Connect with likeminded individuals & grow your network

TBLI Capital Connect Client Highlight

Regenovation

Meet Regenovation, a regenerative hardware company turning agricultural waste into clean water, biofuels, and carbon-rich soil amendments. Their modular micro-factories—EcoStill and WEDEW—operate off-grid to convert farm waste into high-value climate solutions.

By decentralizing production and bringing circular economy tech directly to the field, Regenovation empowers farmers, disaster relief teams, and off-grid communities to unlock new revenue streams while restoring ecosystems.

Contact TBLI Capital Connect for more details on Regenovation: robert@tbliadvisorygroup.com

Are you interested in engaging TBLI for our Capital Connect services? Book a call here

TBLI Radical Truth Podcast

Unraveling Illusions - Sustainable Energy as solution /w Prof. Simon Michaux

Today I’m joined by Professor Simon Michaux, Associate Professor of Geometallurgy at the Geological Survey of Finland, in the Circular Economy Solutions Unit. With a background in physics, geology, and a PhD in mining engineering from the University of Queensland, Simon brings decades of experience—from 18 years in the Australian mining sector, to academic work in Belgium on circular economy and industrial recycling, and now leading research at GTK in Finland.

Simon’s focus is on rethinking how we manage the industrial system as we face two major challenges: the scarcity of critical minerals and the global shift away from fossil fuels. He’s developing a comprehensive framework to connect energy, minerals, and industrial development—arguing that many of our current transition strategies simply don’t hold up to logistical reality.

In this conversation, we’ll explore the hard questions around the energy transition—from fossil fuels to renewables and electric vehicles—and the material constraints that come with it. What’s standing in the way? What would a more practical path forward look like?

What you’ll learn:

-

How much material would a full energy transition actually require?

-

Is 100% renewables even possible at scale?

-

And can we realistically phase out fossil fuels without a major industrial rethink?

Global recycling rates have fallen for eighth year running, report finds

Researchers call for investment in ‘circular solutions’ as consumption rises faster than growth in population

NERC warns of summer grid strain amid load growth and heat risks

By: Kevin Clark - https://www.renewableenergyworld.com

Load growth and expected higher temperatures could push peak demand higher this summer, potentially straining resources in some regions, according to the North American Electric Reliability Corporation (NERC) 2025 Summer Reliability Assessment.

Although the North American Bulk Power System (BPS) is expected to have sufficient resources under normal summer conditions, NERC cautioned that grid operators in many regions may face challenges during periods of high demand due to a resource mix that is generally less flexible and more variable.

Since last summer, NERC said the aggregate of peak electricity demand for its 23 assessment areas has risen by over 10 GW—more than double the year-to-year increase that occurred between the summers of 2023 and 2024.

15 of the 23 regions expect higher peak summer demand in 2025, according to NERC’s assessment. Above-average temperatures and below-average precipitation are expected across much of North America. Temperature is one of the main drivers of demand and can contribute to forced outages for generation and other system equipment.

New data centers, electrification and industrial activity continue to drive load growth forecasts. NERC’s report projects notable demand increases in the U.S. West (+5%), where a new peak demand record was set last summer; and SERC Southeast, driven by economic growth, industrial activity, and data mining.

Retirements and reliability issues for aging assets

Adding to these challenges, more than 7.4 GW of generation capacity— including 2.5 GW of natural gas and 2.1 GW of coal-fired units—has been retired or deactivated ahead of the upcoming summer.

Active but aging generation facilities also present increased challenges to maintaining generator readiness and resource adequacy, NERC said. Forced outage rates for conventional generators and wind resources have trended historically high in recent years, the organization reported. System operators face an increasing risk of resource shortfalls and operating challenges caused by forced generator outages, especially during periods of high demand or when fewer conventional resources are dispatched to serve load.

There are greater threats to BPS reliability in regions where aging resources are further depended upon to provide essential reliability services. In the Southwest, for example, a portion of capacity has been in operation for roughly 60 years. Electric utilities in this region have also described aging generation as a reliability challenge, NERC reported.

Historical performance has demonstrated the need for planning for elevated forced outage rates for these aging generators. Older generators can also require extensive overhauls, such as generator rewinds, that take resources out of service for extended periods of time as findings can lead to additional unplanned maintenance.

Inverter-based resource concerns

Growth in solar photovoltaic (PV) and battery storage resources has accelerated with the addition of 30 GW of nameplate solar PV resources and 13 GW of new battery storage, according to the assessment. The new solar and battery resource additions are expected to provide over 35 GW in summer on-peak capacity. New wind resources are expected to provide 5 GW on peak.

In Texas, California and across the U.S. West, the influx of battery energy storage in recent years has markedly improved the ability to manage energy risks during challenging summer periods, NERC said.

However, NERC has cautioned that grid operators must remain alert to the risk of inverter-based resources (IBRs) unexpectedly tripping offline during grid disturbances—a persistent near-term reliability concern. To address this, NERC continues to collaborate with industry on long-term solutions.

Read full article

Sustainable ocean economy could create 51 million jobs by 2050, report finds

By: Karolina Adamkiewicz - Impact-Investor.com

Ocean Panel’s paper on ocean employment highlights the challenges and opportunities for employment and economic growth in the transition to a sustainable blue economy.

The High Level Panel for a Sustainable Ocean Economy (Ocean Panel), a global initiative of leaders from 18 countries, has published a ‘blue paper’ in partnership with its secretariat the World Resources Institute (WRI). The paper analyses the wealth of untapped employment opportunities available in the transition towards a sustainable ocean economy over the next 25 years.

The 126-page report, which is aimed at decision-makers, industry leaders and other stakeholders, looks at the challenges that have to be overcome in order to achieve a just transition for people working in and around the ocean economy. It also examines opportunities for action, including through the deployment of funding mechanisms such as green and blue bonds and impact investing.

The report found that the formal ocean economy employs at least 133 million people globally. With the right support in place that figure could grow by 51 million by 2050 to 184 million, an increase of 1.5% per year from a 2019 baseline. The report’s authors also acknowledge that the number of people employed by the ocean economy is likely to be larger still, given data gaps in subsistence and informal employment in sectors such as tourism and aquaculture and fishing.

More focus needed

Speaking to Impact Investor, Tom Pickerell, global director of the ocean programme at the WRI who also heads up the secretariat for the Ocean Panel, said that investment in the ocean economy has lagged investment elsewhere and that this needed to change.

“When it comes to the ocean economy, I think as terrestrial beings, we have not given it enough focus. It has been a case of ‘out of sight, out of mind’,” he said, explaining that only 0.1% of funding channelled to the UN’s SDGs goes to SDG14- Life below water.

“Investment is absolutely critical for so many different reasons, not least that over three billion people rely on blue foods for their survival. In terms of jobs, our report also found that there are possibly more than 250 million people, including informal and subsistence workers, in the ocean economy but we need better data.”

The report was commissioned in response to one of 14 outcomes outlined in the Ocean Panel’s strategic roadmap which has set a date of 2030 to transition towards a sustainable ocean economy.

“Part of our work is to help them to make progress. This employment report is one of those pieces of work,” said Pickerell.

Workforce change

The report identifies seven key drivers of workforce change such as climate change, which the authors say will significantly affect employment in ocean economy sectors through changes to the abundance and distribution of fish stocks, increasing sea-level rise, the intensity and frequency of extreme weather events and algal blooms, and investment in offshore wind, tidal and solar energy projects.

“There are climate-related biochemical reasons for investing in oceans and the ocean workforce”, said Pickerell, highlighting that oceans are responsible for 50% of oxygen produced on the Earth.

“It is also the biggest carbon sink in the world. So, we need to actively be managing the ocean and see it as an ally in the fight against climate change. Ocean-based climate solutions such as wind power, blue foods or green carbon dioxide removal can contribute to about 30% of the emissions gap needed to maintain us on that 1.5C trajectory,” he said, referring to the Paris Agreement goal to limit global temperature rise.

Read full article

https://mail.tbligroup.com/emailapp/index.php/lists/vr9326mjcm0e8/unsubscribe

Global ESG Funds Suffer Record Outflows Amid Geopolitical and Regulatory Uncertainty

By: Jeremy Whannell - Born2invest.com

Global ESG funds saw $8.6 billion in net outflows in Q1 2025, reversing previous gains and marking Europe’s first quarterly outflow since 2018. U.S. and Asia also declined, while Canada and Australia remained resilient. Geopolitical tensions, U.S. policy shifts, and regulatory uncertainty hurt investor confidence, raising doubts about sustainable strategies’ viability and performance.

In the first quarter of 2025, the global ESG funds universe recorded net outflows of $8.6 billion, a record low that marked a sharp reversal from inflows of $18.1 billion in the previous quarter. This decline, recorded by Morningstar Sustainalytics, is particularly notable as it is the first time since 2018 that European sustainable funds have seen a quarter of net redemptions.

Investor confidence wanes as ESG funds face $8.6B in net outflows, driven by U.S. policy shifts, European regulatory challenges, and weak sector performance

European market withdrawals of $1.2 billion contrast with $20.4 billion in inflows in the fourth quarter of 2024. The United States recorded an even sharper decline, with sustainable funds recording their tenth consecutive quarter of outflows, reaching a total of $6.1 billion in just three months. Asia also lost momentum, with redemptions of $918 million, compared to inflows of $2.8 billion in the previous quarter.

The exception was Japan, which, while still recording outflows, saw an improvement compared to the previous quarter, with redemptions falling to less than $900 million from $1.1 billion in the previous quarter.

In stark contrast to these dynamics, smaller markets such as Canada and Australia/New Zealand have shown surprising resilience, recording net inflows of around $300 million each.

The survey also shows that the organic growth rate of the sustainable funds universe in the first quarter of 2025 fell to -0.27% , compared to +0.54% in the previous quarter. The difference appears even more marked when compared to the global funds universe, which showed positive growth of 0.90%, despite a general slowdown in flows, which went from $847 billion to $530 billion.

In this rather turbulent environment, BlackRock continues to maintain its leadership among global asset managers in the sustainable funds sector, with 403 billion dollars in assets under management in mutual funds and ETFs. UBS follows with 179 billion and Amundi with 178 billion.

The causes of ESG funds outflows

European investors’ confidence has been heavily affected by an increasingly uncertain geopolitical environment, further exacerbated by Donald Trump’s return to the US presidency. His openly hostile approach to climate issues and anti-ESG measures, including the well-known executive orders against DEI policies, have had a domino effect also beyond the US borders.

The resulting increase in legal risks has in fact pushed many US asset managers to adopt a more cautious line in promoting ESG strategies, generating hesitation among European investors and calling into question the idea of a global alignment on climate goals.

Further complicating the European scenario is the internal regulatory evolution, which makes it increasingly difficult for operators to maintain a coherent ESG proposal. Finally, regulatory uncertainties are intertwined with the disappointing performance of some key sectors of the ecological transition, such as clean energy, fueling further doubts about the effectiveness of sustainable strategies.

Source