Your weekly guide to Sustainable Investment

TBLI Radical Truth Podcast

Financing Survival: How the Green Climate Fund is Driving Private Capital into Climate Action /w Kavita Sinha

Welcome to TBLI Radical Truth, the podcast that uncovers the hidden dynamics of sustainable finance and explores the bold ideas reshaping our collective future.

In this episode, we speak with Kavita Sinha, Director of the Private Sector Facility at the Green Climate Fund (GCF), the world’s largest dedicated climate finance institution. With decades of experience spanning clean energy, entrepreneurship, international development, and impact finance, Kavita is leading efforts to mobilize private capital at scale for climate solutions.

In “Financing Survival,” we dive into how the GCF is channeling billions into transformative projects—helping developing nations adapt to climate risks, accelerate energy transitions, and build resilience. We’ll explore what it takes to align private sector incentives with public climate goals, and why capital flows to the Global South are key to solving the climate crisis.

TBLI Radical Truth features the unfiltered voices of leaders working on the frontlines of impact and ESG—pushing finance beyond convention toward survival and sustainability.

Let’s begin our conversation with Kavita Sinha of the Green Climate Fund.

Listen to the full podcast

This is Radical Truth.

GCF Project Funding Sources:

https://www.greenclimate.fund/project/fp186

https://www.greenclimate.fund/project/fp223

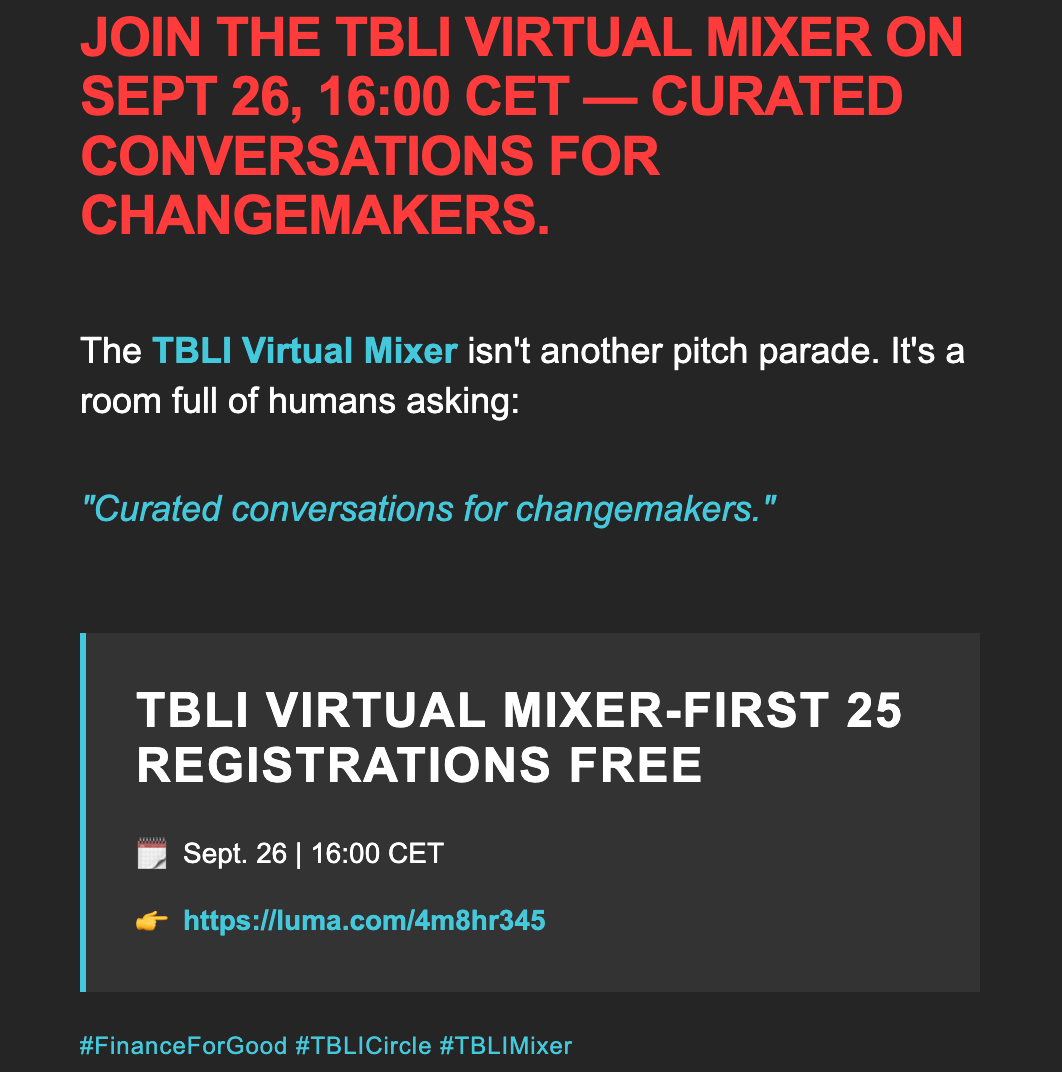

TBLI Virtual Mixer

We’re hosting the next TBLI Virtual Mixer on Sept 26, and I wanted to make sure your friends don’t miss out.

You know it’s not your average networking event — it’s curated, energising, and full of people who get it.

Invite someone who deserves to be in that room:

TrustVC

.jpg)

🚨 Founders deserve better 🚨

Too many get ghosted. Too many LPs find out too late.

That’s why we launched TrustVC.org — the review platform VCs never wanted, but founders and LPs always needed.

✔️ Founders can rate investors

✔️ LPs can spot red flags early

✔️ Fair, founder-friendly firms get recognized

👉 If you’ve worked with investors, leave a review or add a firm today. Let’s bring sunlight to startup funding.

🔗 https://www.trustvc.org/

Just launched: TrustVC.org — the investor review platform VCs never wanted, but founders always needed.

TBLI Circle Open Mic & Networking 🎤

📅 Sept 11, 17:00 CET

Step up and share what matters — your project, your vision, your talent. You’ve got 60 seconds to make an impact.

🌍 Connect with purpose-driven peers, spark collaborations, and grow your network.

✨ Not yet a member? Claim your 2-week free trial and join in.

The Corporate Death Rattle: A LinkedIn Post Nobody Asked For

Edited Chapter from Robert Rubinstein's upcoming book Radical Truth

Ladies and gentlemen of LinkedIn, gather 'round for some uncomfortable truths that'll make your quarterly earnings reports look like children's fairy tales.

The Elephant in the Boardroom (Wearing a $5,000 Suit)

We need to talk about something that makes executives more uncomfortable than casual Friday in a thong: economic hospice care. Not the kind where we put dying industries out of their misery with a pillow over their quarterly reports, but the kind where we acknowledge that some business models have about as much future as a chocolate teapot in hell.

"The American Dream? You have to be asleep to believe it" George Carlin- and boy, are we having some vivid nightmares about infinite growth on a finite planet.

The Sunk Cost Fallacy Goes to Business School

Here's the thing about sunk costs - they're like that toxic relationship you stayed in for three years because you'd "already invested so much time." Except instead of just ruining your weekends, we're talking about $10 trillion in stranded fossil fuel assets. That's not just a write-off; that's "oops, we accidentally built our entire civilization on something that's going to kill us."

The math is simple: either we manage this decline like adults, or climate change manages it for us like a particularly vindictive accountant with a flamethrower.

Industries That Need to Update Their LinkedIn Status to "Seeking New Opportunities"

Let me be painfully specific about who needs to start polishing their résumés:

- Coal mining (sorry, but "clean coal" is like "healthy cigarettes")

- Industrial beef production (turns out cows are climate terrorists)

- Private jet manufacturing (because nothing says "I care about the planet" like a personal carbon volcano)

- Fast fashion (making clothes designed to fall apart faster than campaign promises)

The standard response? "But what about the jobs? The shareholders? The economic growth?"

Translation: "What about MY expectation that nothing in MY life should ever have to change while the planet burns around me?"

The CEO Who Told the Truth (A Work of Fiction)

Imagine an ExxonMobil CEO standing up tomorrow and saying: "Folks, I've got some bad news. Our business model has about as much future as a screen door on a submarine. We're going to transition to clean energy because, shockingly, we'd like our grandchildren to not curse our graves."

What happens next? The board fires him faster than you can say "fiduciary duty." The stock tanks. Fox News runs segments about "woke capitalism destroying America."

But here's the kicker - everything in that speech would be true. We've just created an economic system where telling the truth is professional suicide.

GDP: The World's Worst Report Card

Our economic metrics are more disconnected from reality than a flat-earther's GPS. GDP counts oil spills as positive economic activity because cleanup creates jobs. It's like measuring your health by how much money you spend on medical bills.

Using GDP to measure economic health is like using a bathroom scale to measure your IQ - it's not just wrong, it's measuring an entirely different dimension of wrongness.

The Hangover is Coming (Whether You Order More Drinks or Not)

Economic hospice care isn't about giving up - it's about facing reality with the same courage you'd use to tell your boss their "synergistic paradigm shift" makes no sense.

The hangover from our growth binge is inevitable. We can either face it with water, aspirin, and a plan, or we can keep drinking and pretend the room isn't spinning.

Your Action Items (Because This is LinkedIn, After All)

For Business Leaders:

- Conduct an honest assessment of whether your business model will survive contact with reality

- Develop transition plans that don't rely on magical thinking

For Investors:

- Stop pretending stranded assets are just "temporarily embarrassed successes"

- Consider that your coastal properties might be more "coastal" than "properties" soon

- Integrate stranded asset risk into all valuation models (revolutionary concept, I know)

- Support shareholder resolutions requiring transition risk disclosure

- Or keep chasing quarterly returns until your beautiful beachfront investments are literally underwater

For Policymakers:

- Establish clear phase-out schedules for harmful industries

- Implement rising carbon prices that reflect true social costs

- Create robust worker transition programs with guaranteed funding

- Or continue taking fossil fuel money while pretending to care about the future, then act surprised when your constituents become climate refugees

For Everyone Else:

- Reflect on whether your identity is so tied to consumption that you've become a walking advertisement for things you don't need

- Support businesses undergoing genuine transitions (not just greenwashing)

- Build community connections that don't depend on shopping

- Or comfort yourself with recycling and LED lightbulbs while continuing to participate in systems destroying the planet - whatever helps you sleep at night in your climate-controlled bedroom

The Bottom Line (Because Executives Love Bottom Lines)

The party's over, folks. Not because we want it to be, but because the planet is sending us the bill. We can either leave gracefully or wait for security to escort us out.

The good news? What comes next might actually be better than what we're leaving behind. An economy that serves human well-being instead of quarterly earnings reports? Revolutionary concept.

But hey, what do I know? I'm just a guy suggesting we stop setting the house on fire to keep warm.

Read full article

Ethiopia’s mega dam has taken 14 years to build:

What it means for the Nile’s 11 river states and why it’s so controversial

By John Mukum Mbaku, Weber State University | The Conversation

In April 2011, Ethiopia began construction of Africa’s largest hydroelectric dam, the Grand Ethiopian Renaissance Dam (GERD), on the Blue Nile river. The dam is expected to generate more than 6,000 megawatts of electricity, effectively transforming Ethiopia into the continent’s largest power exporter.

The dam affects 11 countries, two downstream and nine upstream.

Addis Ababa completed construction of the US$4 billion-plus project in July 2025, mainly with funds sourced from Ethiopians at home and in the diaspora, with an official launch on 9 September 2025. John Mukum Mbaku, who has researched the governance of the Nile’s waters, explains the dam’s potential for Ethiopia – and the controversies that have dogged it.

What are the simmering tensions around the official launch of the dam?

The dispute over the allocation and use of the Nile waters has been going on for many years. This has been exacerbated by climate change, and increased demand for food and water from growing populations.

The 11 countries that share the waters of the Nile have competing development priorities too. These states include Ethiopia, Egypt, Sudan, Rwanda, Tanzania and Kenya.

Egypt and Sudan lie downstream. They receive the river’s waters only after it has passed through the nine upstream states.

Initially, the downstream states, particularly Egypt, opposed the construction of the dam, arguing that it was a threat to their water rights.

However, Ethiopia powered ahead with construction. Egypt and Sudan then shifted negotiations to securing an agreement for filling and operating the dam.

The two downstream states had suggested that filling the dam should take about 12 to 21 years in order to protect their water supply. For domestic and political reasons, Addis Ababa prefered a shorter filling period. In addition, Egypt and Sudan argued that filling the reservoir without a legally binding agreement would disregard their interests and rights.

But with the dam now fully filled and due to be officially inaugurated on 9 September 2025, the issue of a binding agreement for filling the dam’s reservoir is moot.

Egypt and Sudan’s political and diplomatic efforts highlight what they say is the illegality of unilaterally operating the dam without a binding agreement. Despite the intervention of the African Union and the US government, as well as appeals by Egypt to the UN Security Council, the three countries haven’t been able to secure a deal.

Part of the reason is that Egypt has insisted that any negotiations on water allocation begin with the rights granted to it under its 1959 Nile Waters Treaty with Sudan.

Under this agreement, Egypt was granted 66% of the Nile’s estimated average annual water flow of 84 billion cubic meters. Sudan got 22%. The treaty ignores upstream countries’ legal claims to Nile waters, since 10 billion cubic meters were reserved for seepage and evaporation. Ethiopia’s highlands, for instance, supply more than 86% of the water that flows into the Nile River.

Egypt continues to argue that Ethiopia’s dam is a threat to its water security and that, if necessary, it will take measures to protect what it refers to as its “historical rights” to Nile waters.

Egypt relies on the Nile for more than 90% of its fresh water supplies. The country’s water needs have risen as its population has grown and its economy has expanded significantly.

However, Egypt and Sudan’s insistence on keeping their historical water shares cannot be considered equitable and reasonable. Additionally, Cairo doesn’t appear to be prioritising a water-use approach that acknowledges the legal claims of upstream states to the Nile’s waters.

Instead of improving and updating its water infrastructure, minimising wasteful irrigation practices and generally improving water use, Egypt has focused on grandiose mega projects that are putting significant stress on the region’s scarce water resources.

Sudan, which has been battling a devastating civil war since 2023, has raised concerns about Ethiopia’s dam affecting the operations of its own dams. This would make it more difficult to manage Khartoum’s development plans.

Read full article

Billions spent, miles to go: The story of California’s failure to build high-speed rail

California’s dream of building a high-speed rail system linking San Francisco and L.A. is a cautionary tale of ambition outpacing funding, planning, and federal support.

Seventeen years ago, Californians bet on a grand vision of the future. They narrowly approved a $10 billion bond issue to build a high-speed rail line that would zip between San Francisco and Los Angeles in under three hours. This technological marvel would slash emissions, revitalize the state’s Central Valley, and, with some financial help from the feds and private sector, provide the fast, efficient, and convenient travel Asia and Europe have long enjoyed.

State officials promised to deliver this transit utopia by 2020. Instead, costs have more than doubled, little track has been laid, and service isn’t expected to begin before 2030 — and only between Bakersfield and Merced, two cities far from the line’s ultimate destinations.

It’s little wonder the project finds itself in a precarious financial position, fighting political headwinds, and deemed a boondoggle by everyone from federal Transportation Secretary Sean Duffy to Abundance authors Ezra Klein and Derek Thompson. “In the time California has spent failing to complete its 500-mile high-speed rail system,” they wrote, “China has built more than 23,000 miles of high speed rail.”

The reasons for this vary with who’s being asked, but people with expertise often cite three fundamental missteps: creating a new agency to lead the effort, failing to secure adequate funding from the start, and choosing a route through California’s agricultural heartland. The state’s strict environmental review process hasn’t helped, either.

Such struggles are not unique to the Golden State, where support for the project remains strong. Although the private sector venture Brightline has seen some success, publicly funded high-speed rail efforts in Texas, Ohio, Washington, D.C., and beyond have stalled. Regulatory complexity, a political environment that favors cars and highways, and constant funding challenges stymie America’s aspirations even as other countries have spent big on tens of thousands of miles of track. Governor Gavin Newsom promises to see the nation’s most ambitious rail project through despite recently losing all federal support, but its troubled path underscores the systemic challenges of building big in America.

California has always been a car-crazy place, and by the early 1990s, transportation studies made clear that its highways would not keep pace with the growth to come. Policymakers saw an answer in bullet trains. The Legislature established the California High-Speed Rail Authority in 1996 and gave it the tough job of planning, designing, building, and running the system.

Some consider that a mistake because the agency lacked experience managing so big a project and navigating complex bureaucracy. Even some rail supporters concede it would have been better to let the authority provide oversight and leave the heavy lifting to the state Department of Transportation, or CalTrans. “It’s building a lot of overpasses and right-of-way, which Caltrans does all the time,” said Ethan Elkind, director of the University of California, Berkeley climate program in its Center for Law, Energy, and the Environment.

Without that experience, the authority’s 10 employees relied heavily on consultants like engineering firm WSP, running up expenses. “We paid WSP and their predecessor more than $800 million in consulting fees,” said Lou Thompson. He chaired the High Speed Rail Peer Review Group, established in 2008 to provide project oversight, from 2012 until 2024. The authority has in recent years eased its reliance on consultants, who reportedly have gone from 70 percent of its workforce to 45 percent over the past seven years.

Once the High-Speed Rail Authority set up shop, work proceeded in fits and starts. Even as it considered routes and started the myriad bureaucratic tasks the project required, political interest waxed and waned with the state’s fiscal health. Skeptics lamented the cost and questioned whether bullet trains would attract enough riders to be worthwhile. But rail advocates, environmentalists, unions, and others kept pushing forward and in 2008 convinced voters to approve Proposition 1A, securing $10 billion to finance construction.

Read full article

Bottom trawling to continue in English protected waters, government rules

By: Helena Horton - The Guardian

Defra says blanket ban on ‘destructive’ fishing practice disproportionate as MPs urge minister to reconsider

Artificial neural network tool to detect wildfire-sparking powerline faults

By Clarion Energy Content Directors

A project run by Eaton and NREL has developed a tool that can detect powerline faults otherwise difficult to detect, enabling utility companies to reduce the chance of both power outages and wildfires.

The tool was developed by the power management company alongside the US’s National Renewable Energy Laboratory (NREL) via a project funded by the US Army Construction Engineering Research Laboratory (CERL).

Commenting in a release was Richard Bryce, a senior researcher in power systems at NREL and lead on the project: “The intention here is to enhance resilience in the power system and to enable faster responses during extreme events.

“We want to provide utility companies with the tools for a more resilient power system with better reliability and security for customers that mitigates the potential for wildfires caused by high-impedance faults.”

HiZ detection project

The project was designed to use machine learning to detect high-impedance (HiZ) faults, which is when an energized conductor, such as a fallen wire, comes into contact with the ground, causing a short. An HiZ fault produces a small amount of energy and are often not detected. But they can cause sparks that ignite flammable material in the area, which can ultimately lead to a wildfire.

For the project, Eaton conducted extensive evaluations in a simulated environment. The scenarios accounted for various downed-conductor events, such as different ground surfaces like grass and gravel, moisture levels, common US tree species, and other external considerations.

The resulting data was shared with NREL’s research team. Using NREL’s grid simulation capabilities and field data from multiple US utility companies, researchers were able to inject the data into the computer-aided design platform PSCAD (Power Systems Computer Aided Design). This then created a large dataset that included more HiZ fault scenarios than what could be produced in the field or in a controlled laboratory setting, says NREL in a release.

These simulated HiZ fault scenarios and datasets were used to train an ensemble of artificial neural networks (ANNs). These were down-selected to the most effective at identifying HiZ fault states, resulting in the tool, which NREL says is all but ready for real power systems. Once the ANN ensemble detects a fault, utility companies can prioritize sending resources quickly to that area to reduce the chance of both power outages and wildfires.

“There were pieces that came together beautifully for this project in a way that’s unique to NREL,” said Bryce.

“We had testing through our partnership with Eaton that provided real data that is experimentally derived, and then we were able to leverage NREL’s high-performance computing and machine learning to provide a solution to utilities which has a very significant, immediate real-world impact.”

NREL says their team is working with utilities across the country, as well as international partners, to generalize the technology, increasing the scalability of the algorithm to be broadly applicable in the US and beyond.

Originally published by Yusuf Latief in Smart Energy International.

Source